European equities jumped in the last month of the year, thin trading towards the end of the month due to the holiday season contributed to the Bull Run, despite rising pandemic numbers. Over the month of December, the European STOXX index rose 5.37% (6.06% in US$ terms).

While the economic data remained positive, the fundamentals are weaker than the US, which dims it outlook as the speed of economic recovery is poised to slow down in 2022. More importantly, inflation remains as an unresolved issue, with the latest CPI figure hitting a new record high again. That said, the ECB was one of the few central bank that have kept their stance unchanged despite rising inflation. The latest figure has retreating in MoM terms could suggest that the peak inflation might have been behind us as suggested by ECB President Lagarde, posing less of a problem.

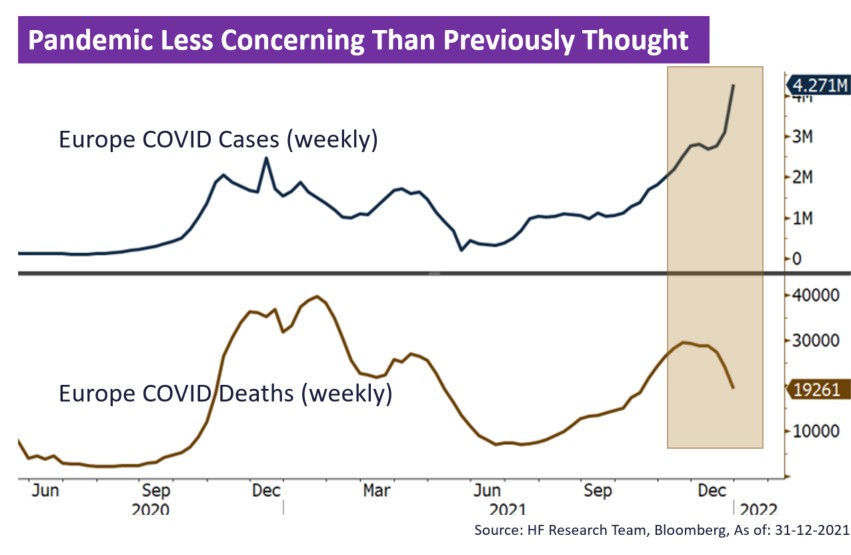

The new Omicron variant has become the dominant COVID strain in most countries. While preliminary reports have shown that while this new strain is more infectious, symptoms are seemingly milder, and contracting this strain could offer better protection against previous variants, which is positive for the economic outlook. Even though several European governments have re-imposing certain restrictions, a majority of them are targeting the unvaccinated, henceforth limiting the impact to the overall economy. Expect the European outlook in 2022 to remain modestly positive, weaker economic momentum is balanced out by the supportive monetary policy, while easing pandemic fears should also reduce the downward pressure on the equity market.