US

US

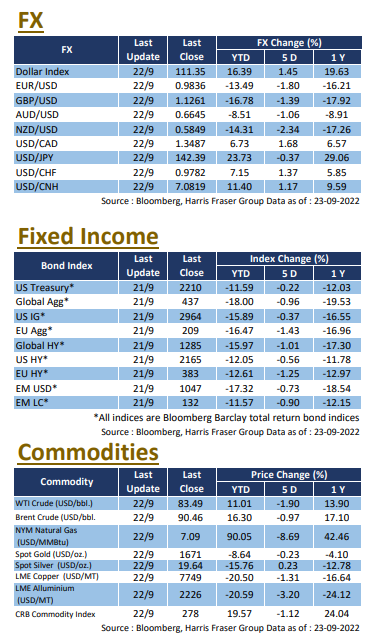

US markets extended the bear run this week, as concerns over the monetary tightening continued to roil markets. Over the past 5 days ending Thursday, the 3 major indices lost 2.86-4.20%. The Federal Reserve held the September interest rate meeting this week, and hikes rates by 75 bps as expected, which was the third supersized hike in a row. The latest Fed Dot Plot also shows consensus between Fed members, expect another 125 bps in rate hikes before year end, and rates in 2023 to be above of that of 2022. In response to the Fed hikes, bond yields further rose, 2Y treasury yields surpassed 4% for the first time since the Global Financial Crisis.

According to Fed President Jerome Powell, he expects below trend growth in the US economy as a price to pay for reigning in inflation, he also admitted that recession is a possibility. The Fed also downward revised GDP growth forecasts for 2022 and 2023 to 0.2% and 1.2%. On the economic front, while existing home sales and housing starts were better than market expected, building permits, a leading indicator for the housing market, dropped by 10% MoM in August. The closely watched labour market remains tight, both initial and continuing jobless claims came in lower than market expected, wage pressure arising from this would remain a concern for market participants. Next week, the US will release August data on durable goods orders and PCE data, as well as the Consumer Board consumer confidence index and final figure for University of Michigan consumer sentiment in September.

Europe

Europe

In line with global markets, European equities also fell over the week as concerns over the economy and the prospects of faster rate hikes dampened market sentiment. Over the past 5 days ending Thursday, the UK, French, and German indices were down 1.62-3.89%. Russia announced a partial military mobilisation order, raising concerns over an extended Ukrainian conflict. On the monetary front, the Bank of England held its delayed interest rate meeting this week, raising interest rates by 50 bps, which was slightly lower than the market expected 75 bps. According to the Bank, it expects inflation to hit 11% in October, and the UK to be in recession with a 0.1% contraction in Q3. On the other side of the Channel, the Swiss National Bank hiked interest rates by 75 bps in response to the higher inflation, marking the end of negative interest rates in Europe. Following the hike, US Dollar was up over 1.2% against the Swiss Franc in a single day. For economic fundamentals, Eurozone consumer confidence was -28.8 in September, lower than both the expected -25.8 and the August figure of -25. Eurozone PMI’s on the other hand were disappointing, with September Manufacturing and Services PMIs coming in at 48.5 and 48.9 respectively, both lower than both market expectations and the August figures. Next week, Europe will release its unemployment data for August, as well as business confidence and the latest CPI figure for September.

China

China

Chinese equity markets edged lower awaiting further information on the 20th National Congress of the Chinese Communist Party, while Hong Kong equities followed global markets and logged in more losses. Over the week, the CSI 300 was down XX%, while the Hang Seng Index was down XX%, closing below the 18,000 mark on Friday, which was a new low since the start of the year. It was reported that the Hong Kong government is considering further loosening of its COVID border restrictions, cancelling all hotel quarantine requirements in October, hoping to boost the travel and hospitality industry. On the monetary front, major Hong Kong banks including HSBC, Bank of China, and Standard Charted have raised their prime rates in response to the Fed hikes, casting a shadow over the property market. In other news, the 1-year Loan Prime Rate (LPR) in China was kept unchanged, rout in the China property sector remains a concern for markets. Next week, China will release the NBS Official Manufacturing and Services PMIs, as well as Caixin Manufacturing PMIs for September.