US

US

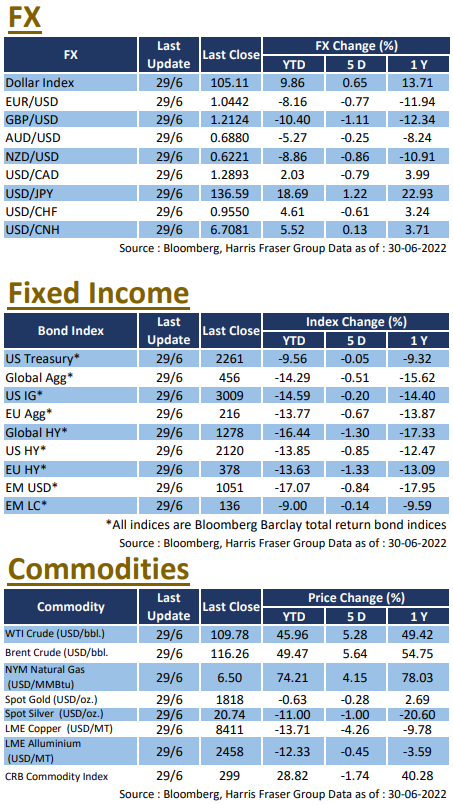

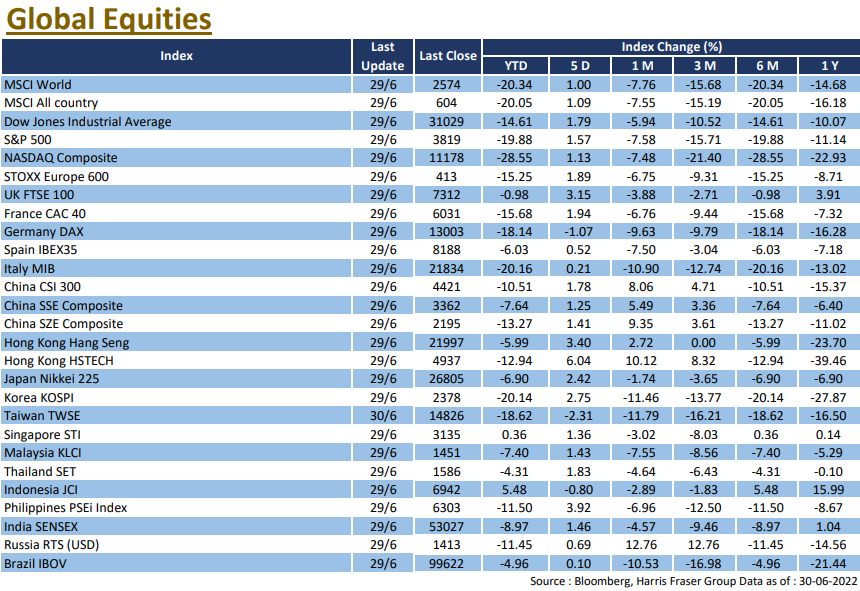

Equities gained slightly on the back of slightly subdued recessionary concerns, but markets lacked clear direction, with the 3 major equity indices gaining 1.13-1.79% over the past 5 days ending Wednesday. US Federal Reserve Chair Jerome Powell spoke at ECB forum, admitted that getting the economy to arrive at a ‘soft landing’ has become harder, but reiterated that slowing down inflation and preserving low unemployment remains the Fed’s target from the start. New York Fed President John Williams mentioned that recession is not his base case for the year although a significant slowdown is likely, and supports significantly higher rates to keep inflation under control. Cleveland Fed President Loretta Mester noted on another occasion that she is advocating for a 75 bps hike in the July meeting if economic conditions remain unchanged, echoing other member’s view on the high inflation.

As for fundamentals, pending home sales surprisingly rebounded to a 0.7% expansion MoM, surpassing both previous month figures and market expectations. On the other hand, consumer confidence waned and came at 98.7, missing market expectations and was markedly lower than the May figure of 103.2, it is also the lowest reading since March 2021. Moreover, the final figure for Q1 GDP was slightly revised lower from -1.5% to -1.6%. Next week, key data including June data on unemployment, ISM services, JOLTS job openings, and Nonfarm payroll figures will be released, the FOMC meeting minutes for June will also be published.

Europe

Europe

European markets continued to show divergent performances, as the German DAX lost 1.07% over the past 5 days ending Wednesday, whilst the UK FTSE and French CAC gained 1.94-2.15% over the same period. During the forum on Central Banking held by the ECB, ECB President Christine Lagarde stated that she is still expecting positive growth in the region, but made it clear that the Bank is ready to move rates at a faster pace if needed, she also mentioned that ‘anti-fragmentation’ tools will be looked into at the July meeting. Markets are now expecting the rate hikes in the next 2 meetings, entering positive territory by September, which will be the first since 2014. German CPI remain high but was lower than market estimates, markets will watch closely if inflationary pressures will continue to ease. Next week, Europe will release the Sentix investor confidence, as well as retail sales figures for May.

China

China

Chinese markets had a decent week, with both Hong Kong and Mainland A-share markets posting gains over the past 5 days ending Thursday. The COVID outbreak in China remain under control, authorities announced relaxations on quarantine rules for inbound travellers, moving from a 14-day rule to a 7+3 model. The announcement lifted market sentiment, and investors are hopeful that it would serve as a starting point for further easing. On the economic data front, both official manufacturing and non-manufacturing PMIs returned to the expansion zone after 3 months of contraction. Next week, Caixin services PMI for June, as well as CPI, PPI, and foreign reserves figures will be released.

US

US Europe

Europe China

China