Weekly Insight July 31

US

US

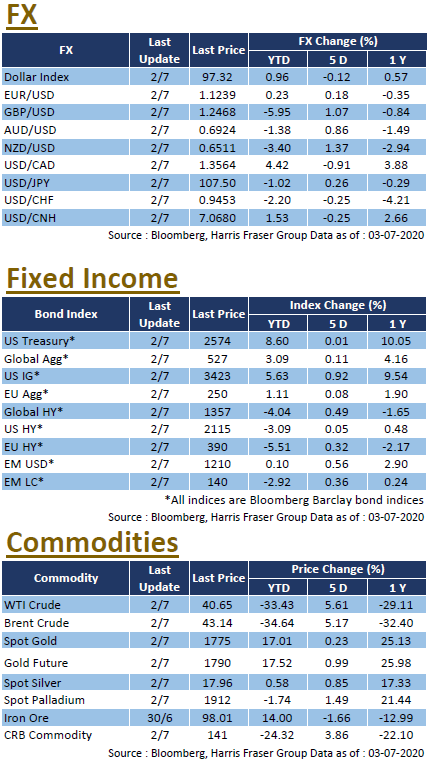

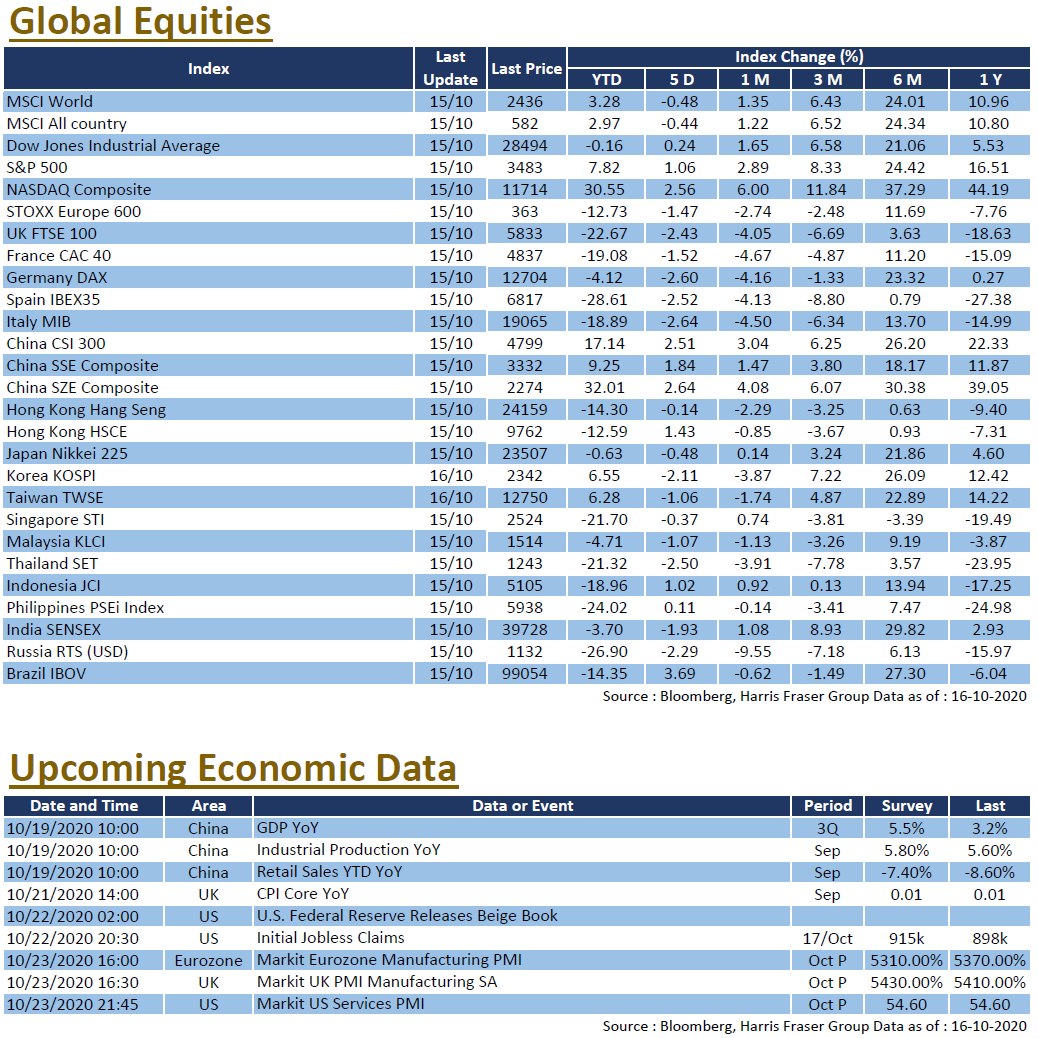

Although the United States just announced that its 2020 Q2 GDP fell 32.9% QoQ annualised, which was the largest drop on record, several tech giants such as Facebook, Apple, Amazon, and Google’s parent company Alphabet still announced earnings beats, driving the tech sector up. Over the past 5 days ending Thursday, the S&P 500 and the NASDAQ rose 0.33% and 1.21% respectively, while the Dow fell 1.27%. The covid epidemic in the US remains severe, the number of covid deaths in Texas reached a new record high. After the interest rate meeting, Fed Chairman Jerome Powell pointed out that more fiscal policies are needed to stimulate the economy, and the idea of hiking rates is completely off the table. On the other hand, US President Trump tweeted the idea of postponing the November elections, but congressmen from both parties opposed the idea, and he does not have the relevant power to actually postpone the elections. Finally, it is worth mentioning that the US dollar index has fallen and reached its lowest level since May 2018, while the gold price has hit a record high. The US will be releasing the latest employment figures, market expects that the Nonfarm Payrolls in July will fall to 1.635 million.

Europe

Europe

European stock markets slightly underperformed. The UK, French, and German equities fell between 3.57% and 5.52% over the past 5 days ending Thursday, lagging behind global markets. As the epidemic continued to ravage across the globe, the European Central Bank required European banks to suspend dividends and stocks buybacks before the end of 2020 in order to maintain financial stability. Germany’s GDP fell by 10.1% in 2020 Q2, while the Eurozone’s GDP fell 12.1% QoQ, both setting new record lows. The Eurozone consumer price index in July rise 0.4% YoY. The Eurozone retail sales data will be announced next week.

China

China

A-shares performed better this week, with the CSI 300 Index rising 4.2% over the week; Hong Kong stocks were slightly worse, falling 0.45% over the same period. China announced satisfactory industrial profits in June, which rose 11.5% YoY. As for the official manufacturing index in July, it came in at 51.1, which was higher than the previous figure of 50.9; However, the July non-manufacturing index was 54.2, slightly lower than last month’s figure of 54.4. On the other hand, the HKD continued to show strength, and the HKMA intervened in currency market twice on Thursday, selling more than 4.6 billion HKD in total. China will announce its July data on imports and exports, foreign reserves, and Caixin manufacturing PMI next week.