Weekly Insight Aug 14

US

US

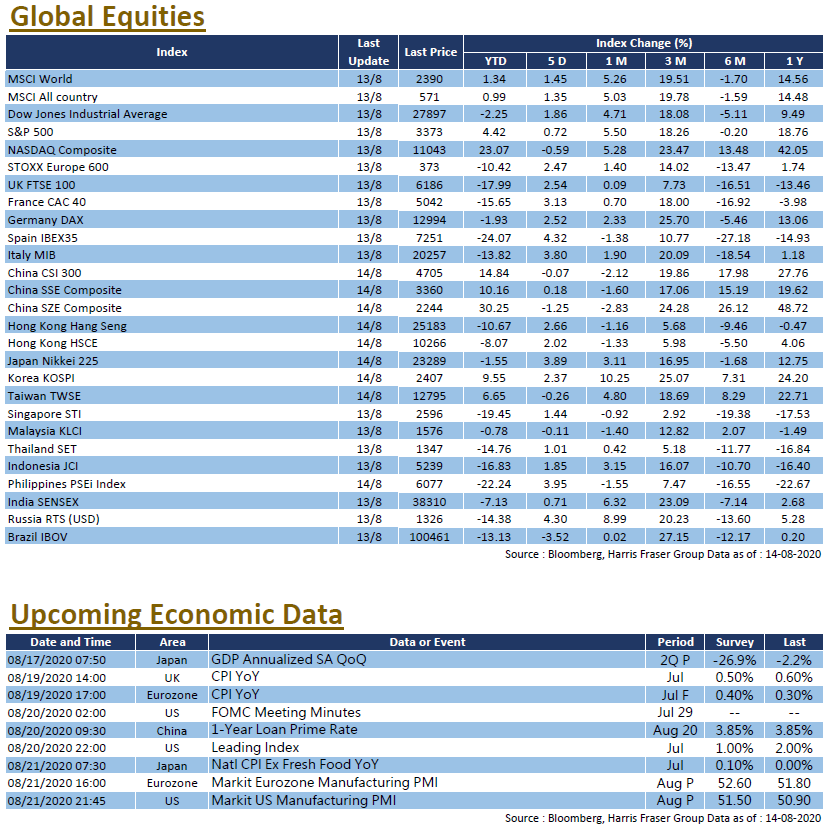

The number of covid cases exceeded 20.9 million globally, of which the United States accounts for more than a quarter of total cases. Despite the serious epidemic situation, the US economic data seems to indicate a strengthening local recovery momentum. The latest number of new jobless claims has fallen below the 1 million mark for the first time since the start of the outbreak. The US stock market remains in an upward trend, the Dow and the S&P 500 index rose 1.86% and 0.72% respectively over the past five trading days ending Thursday, while the NASDAQ fell 0.59%. Russia announced registry of its first COVID-19 vaccine. While the market remains hopeful that the vaccine could help control the epidemic, there are also worries that the vaccine's usage may restrict the current dovish policies of global central banks. Regarding Sino-US trade relations, it was reported that senior officials of both countries will evaluate the implementation of the first phase trade deal around 15th August. As for spot gold, while it did briefly hit a record high, gold prices subsequently plummeted on August 11, setting a record for the largest single day decline over the past seven years. At the time of writing, spot gold sits at $1948 per ounce. Next week, the United States will release the minutes of the Fed July interest rate meeting.

Europe

Europe

The latest focus in Europe remains on the Brexit talks, markets are still speculating whether the UK and EU can reach an agreement before the September deadline. Positive news and data continue to pour in, supporting European equities, the UK, French, and German indexes rose between 2.63% and 3.22% over the past 5 trading days ending Thursday, outperforming global markets. After the UK Prime Minister Boris Johnson and Irish Prime Minister Micheál Martin met on Friday, both expressed optimism about a zero-tariff trade agreement between the UK and EU. Next week, the Eurozone will announce the initial value of the August manufacturing PMI and the finalised July CPI.

China

China

Over the past week, the margin trading balance growth has slowed down, resulting in weaker performances in both the Shanghai and Shenzhen stock markets. The CSI 300 Index fell slightly by 0.07% over the week, while the Hong Kong equities had a better week, the Hang Seng Index gained 2.66% over the same period. In terms of economic data, China's industrial production maintained a positive growth of 4.8% YoY in July; retail sales were weaker, falling 1.1% YoY over the same period, but the decline was less severe than the previous month; the YTD figure in July fixed investment ex rural areas also saw improvement over previous months. China will announce the LPR (Loan Prime Rate) next week, market expects both the 1-year and 5-year rates to remain unchanged.