Weekly Insight October 9

US

US

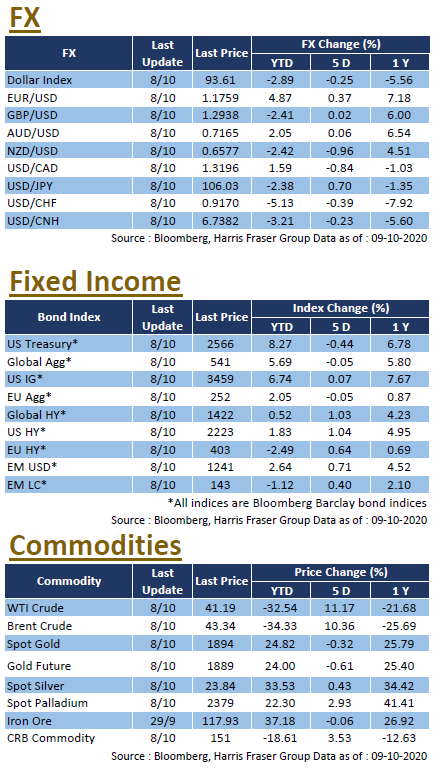

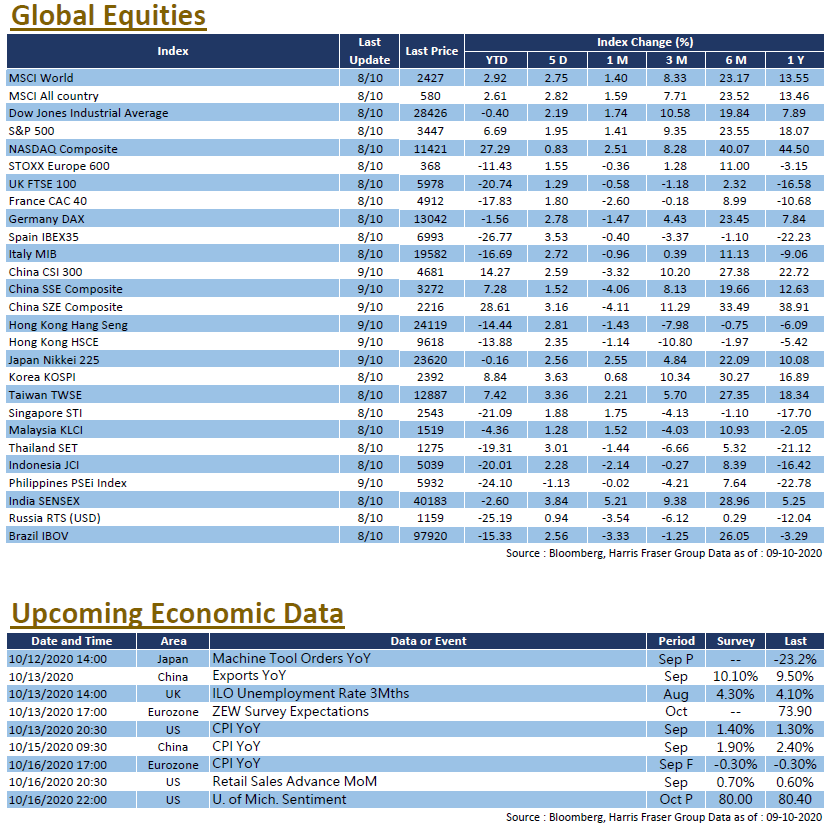

The market still expects more stimulus from Congress, and the recent increase in merger and acquisition activities helped improve market sentiment, driving the rebound in the US stock market. Over the past 5 days ending Thursday, the Dow, NASDAQ, and S&P 500 indexes gained 2.19%, 1.95%, and 0.83% respectively. With the US elections just three weeks away, the market is still concerned if there will be major events affecting the two candidates' prospects. Incumbent US President Donald Trump returned to work in the White House office on Wednesday after undergoing medical treatment, but countrywide polls still show Trump's support lagging behind Biden. The Commission on American Presidential Debates announced that the second presidential debate will be held in video format on the 15th of this month. As for stimulus matters, Trump called off stimulus talks with the Democrats earlier, before adding that he is still willing to support relief measures such as ones for the airline industry, and that he remained open to a larger stimulus package. The US will release CPI, retail sales and other data next week.

EUROPE

EUROPE

European equities followed the rebound in US markets, with the UK, French, and German stocks gaining 1.29% to 2.78% over the past 5 days ending Thursday. The market is concerned about the resurgence of outbreaks in Europe. Even with a new round of lockdown measures, the number of daily cases in many European countries is still at record highs, governments and the European Central Bank said they will provide more support to the economy. That said, European regulators admitted that it is “unlikely” that the vaccine will be available before the end of the year. As for the Brexit trade talks, it was reported that the UK will withdraw from the talks if an agreement is not reached by next week. European Council President Charles Michel also mentioned that the Brexit negotiations have reached a “critical moment”. Next week, the UK will announce the unemployment rate and the Eurozone will release the ZEW economic sentiment index.

CHINA

CHINA

After the weeklong National Day holiday in China, RMB strengthened, the CNH USD rate even closed in the 6.7090 level at one point. The appreciation of the RMB drove the China A-share market up after the long holiday, with the CSI 300 index rising over 2% in a single day. Alibaba's Ant Group will be listed in two markets soon, raising US$35 billion, this will be the largest IPO in the world since Saudi Aramco’s listing. Next week, China's CPI, PPI, and import/export data will be released.