The Chinese stock market rebounded in September. The CSI 300 Index and the Shanghai Composite Index were up 0.39% (0.51% in USD) and 0.66% (0.77% in USD) respectively, while the Hang Seng Index dropped 1.43% (1.46% in USD).

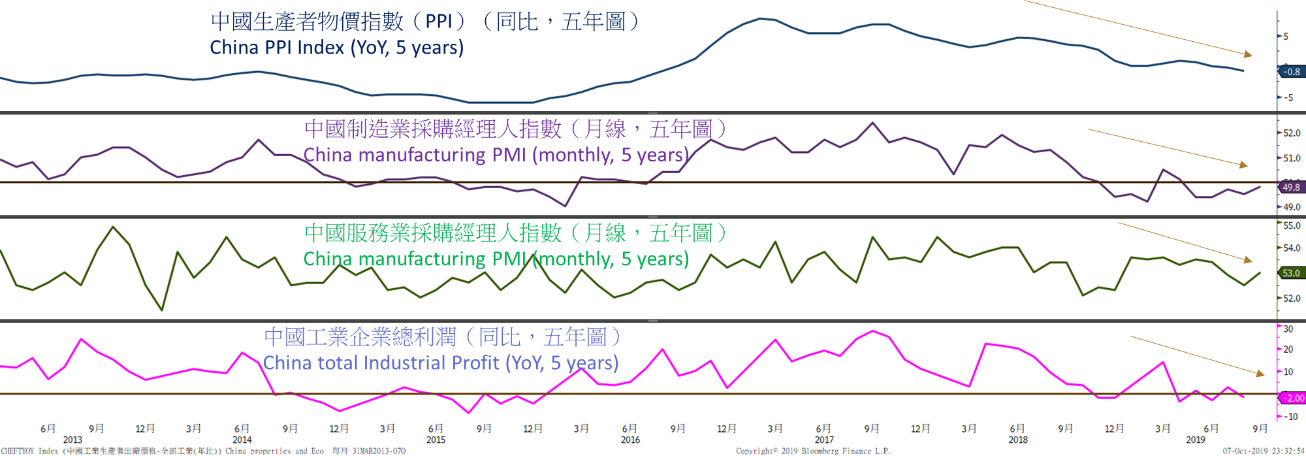

China's overall economic data was still somewhat mixed. In September, both the official manufacturing PMI and Caixin China Manufacturing PMI posted positive surprises, coming in at 49.8 and 51.4 respectively. Yet, growth in the manufacturing industry in China is still expected to be relatively muted. While the August PPI of -0.8% was slightly better than market expectations, it remains in the contraction zone, together with the falling export figures of -1.0% YoY in August, this could mean further weakening in the exporting sectors.

After raising the currency manipulation controversy in August, it was reported that the White House is considering limits to fund flows into China or Chinese related entities via 3 major measures. The measures include limiting Chinese company’s weighting in various Indices, limiting pension funds investment in China, and limiting or even delisting ADRs currently listed in the US exchanges. While these measures do seem farfetched at the moment, the reports could possibly outline future US actions to be taken in order to further pressure China in the trade war.

As the downward pressure continue to mount, the Chinese government has once again introduced policies to stimulate the economy. The People's Bank of China announced further lowering of reserve ratios in early September, releasing RMB 900 billion to the system. While the act is likely going to provide support to the markets, many question the incremental benefits of further cuts. With the large level of cash released back to the system, some experts are also concerned over the rising inflation as the CPI is currently on the higher end. The Premier of the State Council Li Keqiang reiterated the importance of “Six Stabilities” at the State Council, and further supported the local government bond issuances as means to boost the local economy. In light of the recent developments, we continue to suggest investors to stay cautious with regards to the possible economic growth drop off.

Source: Bloomberg, Harris Fraser, Data as of :7-10-2019