Economy continued its recovery in China, but local equity markets had a rough month. The CSI 300 index lost 7.90% (7.96% in US$ terms), the Shanghai Composite was down 5.40% (5.46% in US$ terms), whereas the Hong Kong Hang Seng Index shed 9.94% (10.02% in US$ terms), and the Hang Seng Chinese Enterprise Index lost a whopping 13.41% (13.48% in US$ terms).

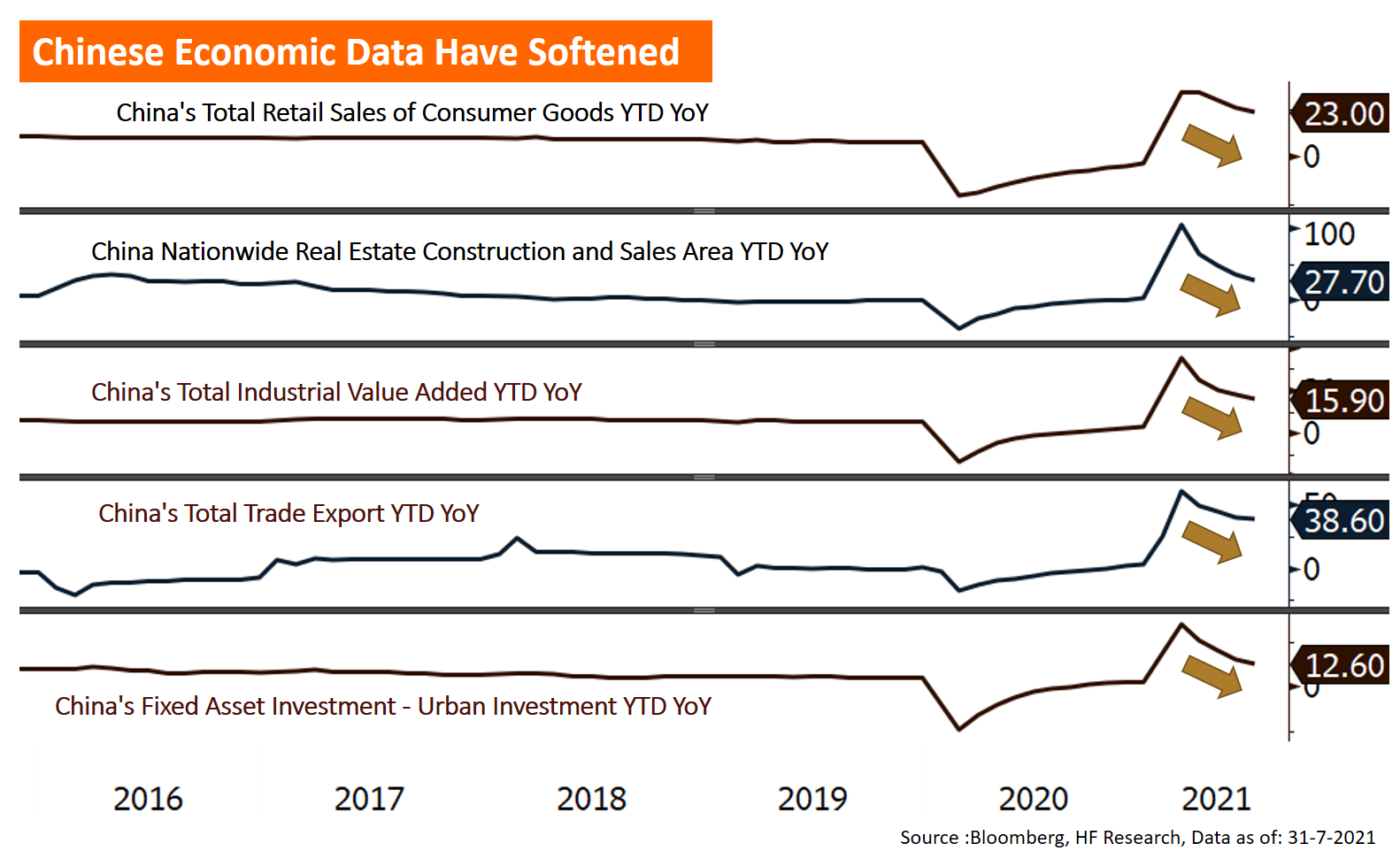

The fundamentals of the economy remains stable, but most of the indicators have slowed down in line with the previous trend. Base effect wears off, and the moderately tight fiscal and monetary policies was negative for the market. Although the PBoC announced a surprise RRR cut of 50 bps during the month, freeing up 1 trillion CNY in liquidity, which did offer a brief support to market sentiment. However, subsequent policy announcements that impacted several sectors raised uncertainties in the market.

Following the scrutiny over several sectors such as internet platform businesses earlier, the target has since then moved on to other industries. Policies such as limiting overseas listing, a non-profit order for the education sector, and criticising the gaming industry, had material impact on the business themselves, and affected the investment sentiment, which was the main reason behind the market crash in July. Overall, the market remain exposed to the downside in the short to mid-term due to policy uncertainty, such that we would refrain from holding excess positions in the market in the near term.