In line with global markets, European equities bounced back supported by solid fundamentals. Risks arising from elevated inflationary pressures had seemingly limited impact on the local market. Over the month of October, the European STOXX 600 index gained 4.55% (4.26% in US$ terms).

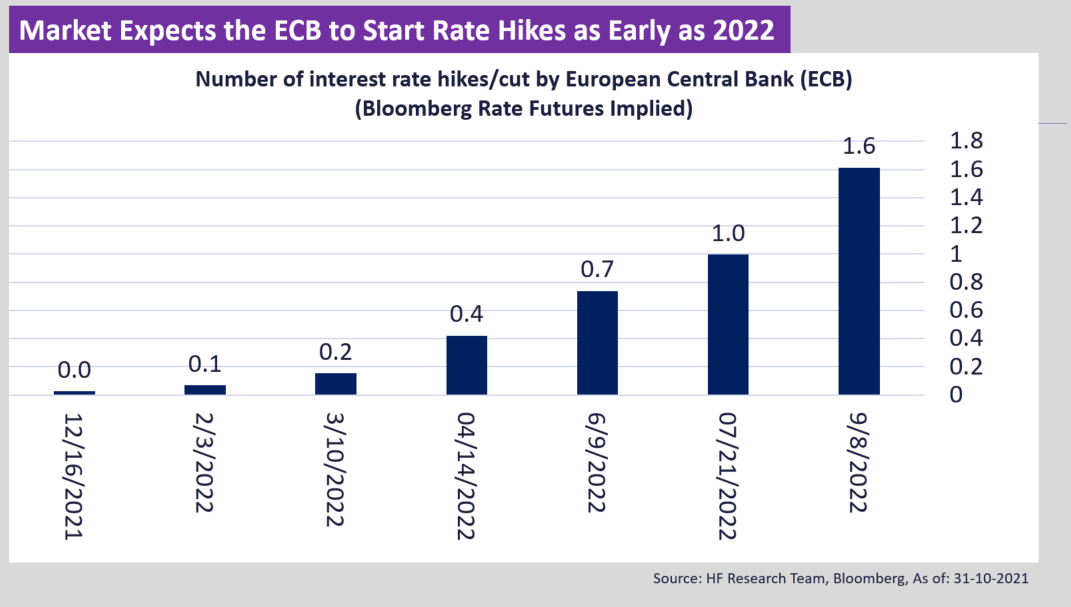

With vaccination rates in Europe hitting target levels, policy making have started to treat covid as a non-factor, with economic activities back to near pre-pandemic levels. Economic fundamentals are steady, but the ongoing energy crisis is expected to last until the end of the year, inflation remain as one of the larger threats to the market. The latest CPI reading in the Eurozone hit a new record high since 2008, markets are concerned if the mounting inflation could force the ECB to tighten their monetary policy earlier than planned. According to Bloomberg interest rate futures, the market is now expecting the ECB to start hiking rates as early as 2022, which could limit the equity upside if it were to materialise.

The ECB kept interest rates unchanged after the interest rate meeting, President Christine Lagarde explicitly mentioned that interest rate futures implied data are not in line with ECB targets. The Bank expects European inflation to fall below 2.0% in 2022 as energy shortage and supply chain issues could resolve by the 1st quarter next year. With the confidence of the ECB, expect monetary policy to stay more accommodative, which should further support equity performance. We remain more positive on European equities in the short to mid-term as valuations and monetary policy stay supportive.