The pandemic returned as a key issue for global equity markets, as markets are concerned that the new highly mutated Omicron variant could once again cause a global lockdown, hindering economic growth. US equities retreated late in the month, the NASDAQ was the sole index ending in the green, ending 0.25% higher in November, while the S&P 500 and Dow Jones lost 0.83% and 3.73% respectively.

While the current pandemic is still currently dominated by the Delta strain at the time of writing, the Omicron has caused fear in the market due to the uncertainty it brings. Early studies have showed that the new variant have a large number of mutations, and that the virus could be more infectious than previous strains. Market fears that there could be more disruption to the global supply chains, and the global service sector could suffer, short term equity market sentiment would likely remain at the lower level before we get more clarity.

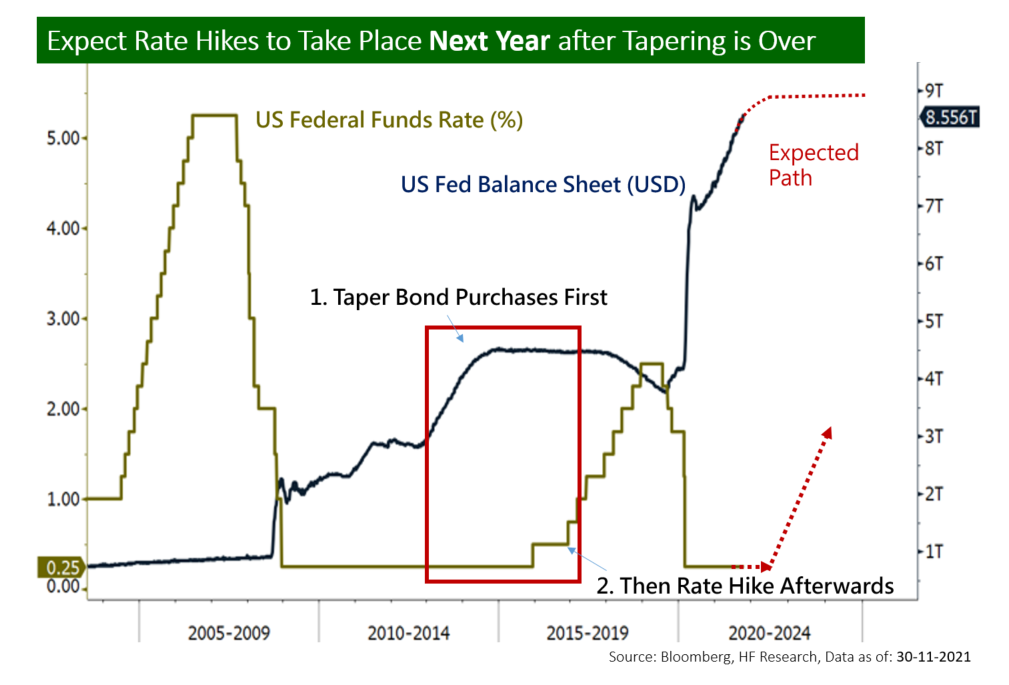

Putting that aside, the economy is decent, but inflation remains as the important unresolved issue, with the figures hitting new record highs in recent decades. To tackle the issue, US Fed President Jerome Powell mentioned that a faster tapering could be appropriate considering the inflation and economic environment, raising the odds of more rate hikes in 2022. While this could limit the equity upside in form of valuation expansion, this marks the end of early recovery in the economic cycle. Henceforth, if the pandemic risk does not fully materialise, we see growth stocks as one of our main picks in the US market for 2022.