With a modest Fed rate cut of 0.25% in September as market expected, trade war news subdued and markets calmed, US equities went up in September. S&P 500, Dow Jones and NASDAQ indices rose 1.72%, 1.95%, and 0.46% respectively

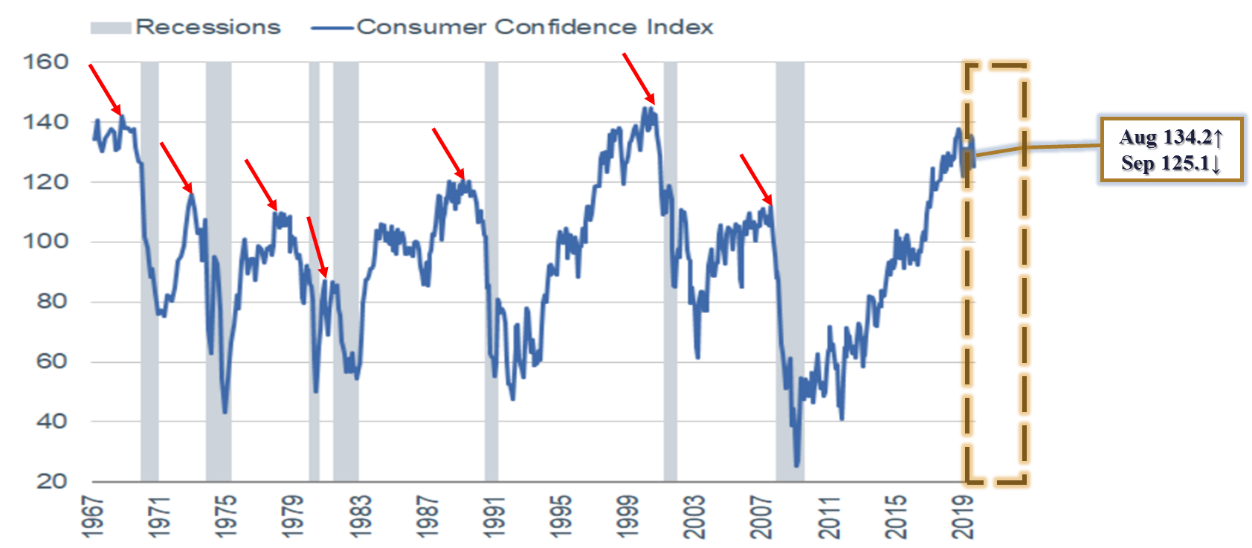

Economic figures continue to show warning signs in the US economy, as Markit and ISM PMI figures continue their downtrend in September. ISM manufacturing PMI missed expectations and remained in the contraction zone at a low of 47.8, which is the second contraction in a row, and the lowest point since July 2009. ISM non-manufacturing was 52.6, which missed the expected figure of 55, and marks the continuing downtrend for non-manufacturing figures. This is important as the US economy is dominated by the service industry. The weakening consumer confidence figures in September, coming in at 125.1 which missed the market consensus by 9 points, further shows a possible faltering economy.

As for the latest trade war development, September has been a relatively calm month as both sides are waiting for trade talks to recommence. Although Chinese trade parties have cancelled planned US farm visits earlier in September, causing a brief panic as the markets were concerned over the strained relations. Still, the scheduled trade talk in mid-October will continue as planned, we might see a positive but limited rally early in October. Overall, we expect limited progress in the trade agreement as fundamental differences remain. Even though the US market remains the most robust equity market from a global perspective, as complex existing issues remain, alongside with the weakening global economy at hand, we do not expect the US markets to sky rocket, investors should continue to stay cautious when investing.

Source: Bloomberg, The Conference Board, Harris Fraser, Data as of: 30-9-2019