Weekly Insight November 5

US

US

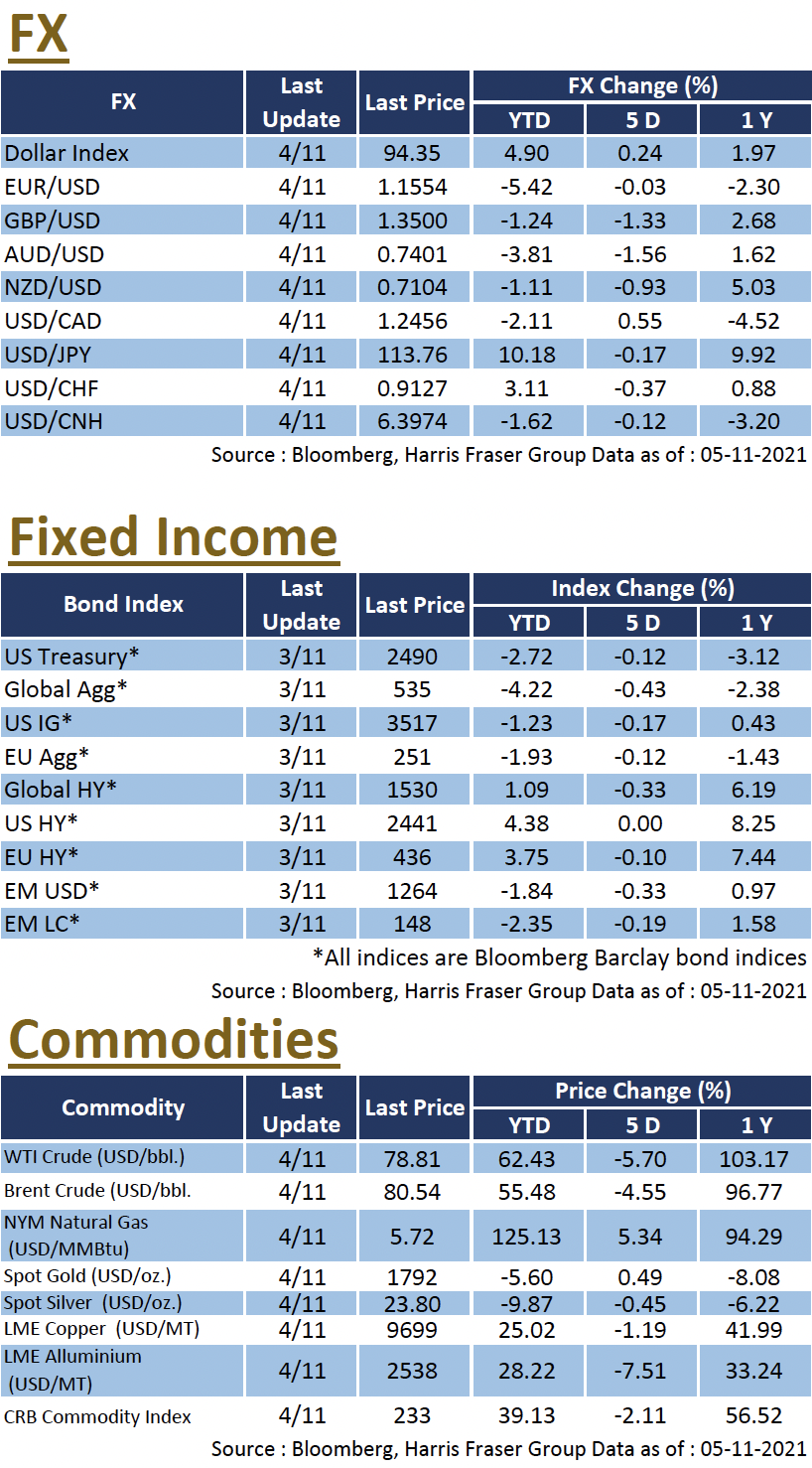

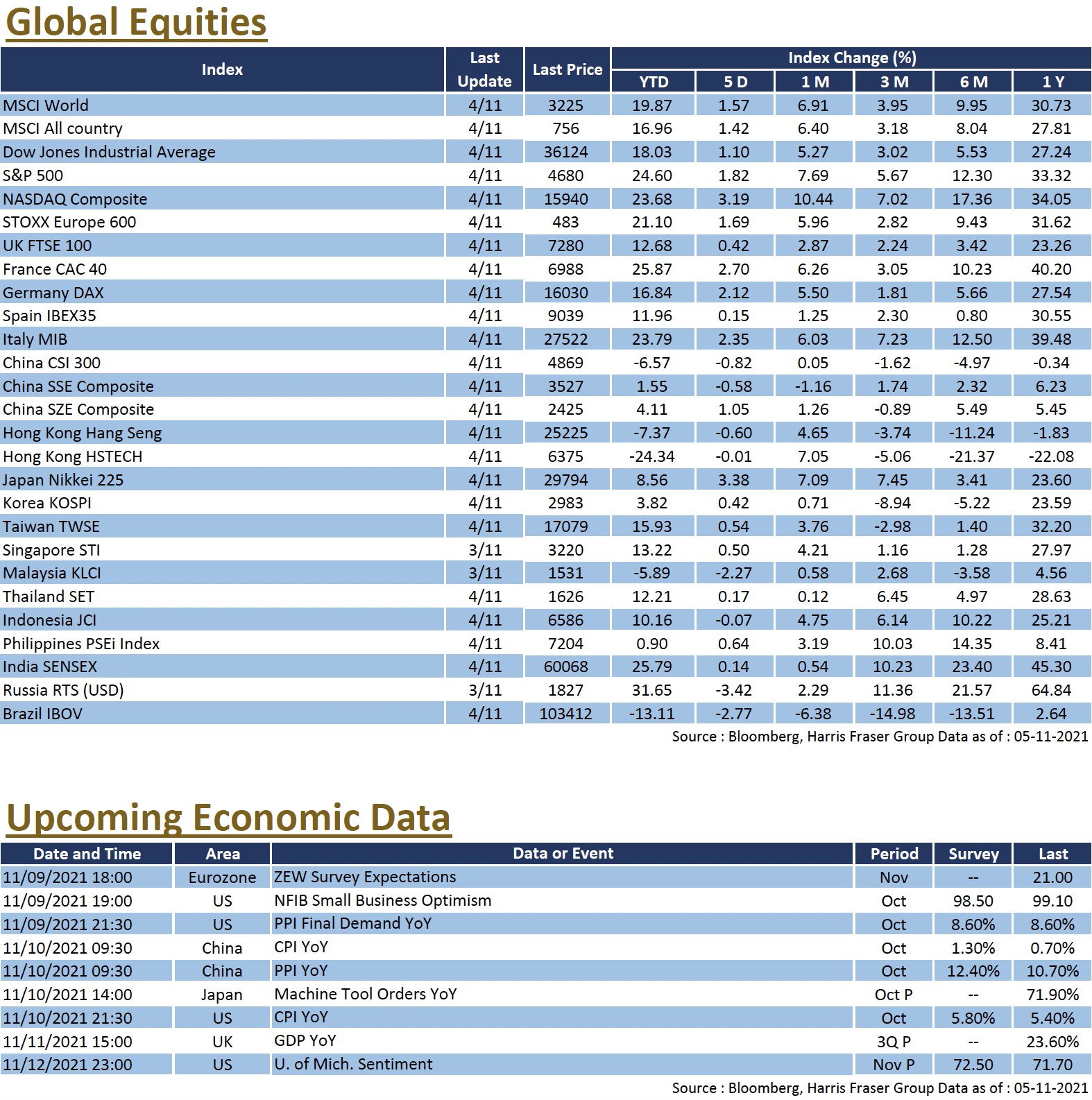

The US Fed announced tapering of its bond purchases, in line with market expectations. This allayed market concerns over uncertainties, coupled with the recent positive economic data, boosted market sentiment, with the Dow, S&P, and Nasdaq gaining between 1.10%, 1.82%, and 3.19% respectively over the past five days ending Thursday. The Fed announced a reduction in bond purchases of $10 billion in Treasuries and $5 billion in mortgage-backed securities per month starting in November, but Chairman Powell noted that the Fed would remain patient on rate hikes. The market was concerned about high energy costs, but oil prices fluctuated after the Saudi-led Organization of Petroleum Exporting Countries and Allies (OPEC+) announced that it stick to its original plan on increasing production by 400,000 barrels per day in December, rejecting Biden's call for more production. Crude oil prices retreated later in the day, and briefly fell below the $80 per barrel level.

For economic data, the Markit Manufacturing PMI slowed slightly to 58.4 in October, but the Markit Services PMI rose to 58.7 in the same period, the ISM Services Index even unexpectedly rose to a record high of 66.7 in October, significantly higher than market expectations of 62.0. As for employment data, the ADP nonfarm payrolls added 571,000 jobs in October, beating the expected 400,000 figure and was the highest in four months. Next week, the US will release October PPI and CPI data, as well as University of Michigan market sentiment data.

Europe

Europe

The Bank of England unexpectedly kept interest rates unchanged after the interest rate meeting, missing market expectations of becoming the world's first major central bank to raise interest rates, sending the pound down 1.37% against the US dollar on the same day; the yield on the 10-year UK government bonds fell below 1% again; however, the FTSE 100 index rose 0.37% in a single day, buoyed by the depreciation in the currency. Over the past 5 days ending Thursday, UK, French, and German equities rose by 0.42%, 2.70%, and 2.12% respectively. On the other hand, although the market expects the European Central Bank to raise interest rates in October 2022, President Christine Lagarde is still stressing that a rate hike next year is very unlikely. Next week, the Eurozone will release the ZEW Economic Sentiment Index for November.

China

China

Hong Kong equities remained under pressure as the market is concerned over the state of the Chinese real estate market, the Hang Seng Index fell below the 25,000 level, down 2.0% over the week; China A-share market was more stable, but the CSI 300 index still fell over 1.35% over the same period. Negative news on Chinese real estate companies continued to emerge, overdue payments on financial management products guaranteed by Kaiser Group, and the subsequent suspension of trading of Kaiser Group and its subsidiaries in Hong Kong, weighed on the Chinese real estate sector. On the economic front, the Caixin China Manufacturing and Services PMI both improved in October. Premier Li Keqiang said China's economy is facing new downward pressure and effective policy adjustment is needed. Next week, China will release CPI and PPI data for October.