Flurry of negative news hit the market, the continued inflation and the resurgence of the pandemic in particular were big pain points, which affects the EM outlook. Over the month of November, EM equities fell in line with global markets, MSCI emerging markets index lost 4.14%.

The short term outlook remains depressed, the headwinds which were in place over the year have not dissipated, with certain aspects even worsening. The pandemic became the foremost issue in the market, large number of mutations found in the new strain resulted in more uncertainty surrounding its infectiousness and severity, with more concerned over its ability to evade the vaccine. Given EM’s overall lower vaccination and weaker infrastructure, the virus could cause more extensive damage in EM economies, have the possible subsequent outbreak not been contained.

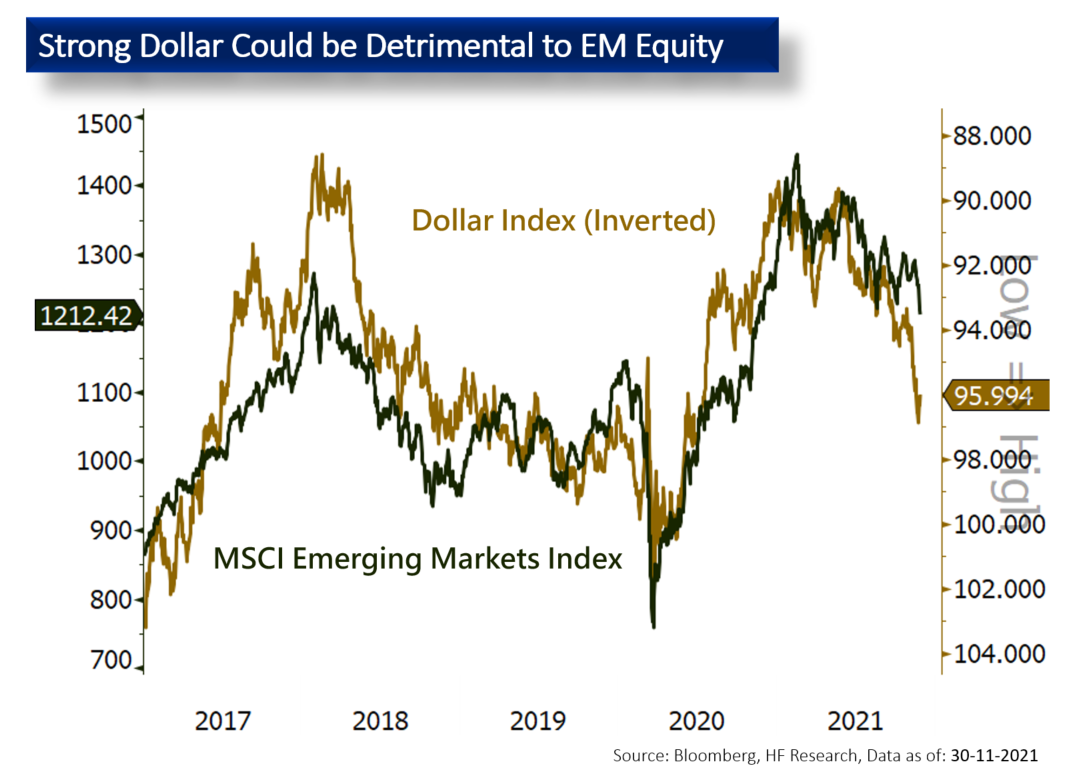

The resurgence of the pandemic also increased the risk of sustained high inflation. With the more stringent measures in place to control the spread of the disease, supply chain disruptions could linger, which in turn bumps up the currently high inflation. At the same time, tightening m onetary policy in the US materialised, the Dollar is expected to strengthen, and EM economies could see pressure ahead in form of hiking rates and capital outflows. We continue to hold a conservative outlook for EM equities in the short term before the dust over the Omicron variant settles, by then one could consider geographies with better pandemic control, as those markets could possibly see recovery further ahead in the New Year.

onetary policy in the US materialised, the Dollar is expected to strengthen, and EM economies could see pressure ahead in form of hiking rates and capital outflows. We continue to hold a conservative outlook for EM equities in the short term before the dust over the Omicron variant settles, by then one could consider geographies with better pandemic control, as those markets could possibly see recovery further ahead in the New Year.