Emerging market equities slightly gained in the last month of the year, but fundamentals remain weaker, and other headwinds exist. Over the month of December, MSCI emerging markets index only gained 1.62%. The Index concluded the year with a 4.59% loss, mainly contributed by the Chinese and Latin America markets.

Heading into the New Year, our EM outlook has remained largely unchanged, as the external environment is still challenging. The overarching pandemic situation could affect EM economies, as the discrepancy in vaccinations likely leads to divergent economic recovery. With lower vaccinations and less control over the pandemic, expect more and longer restrictions in the respective economies, outlook would likely be less positive than their DM counterparts. Weaker fundamentals as reflected by the EM economic indicators further support our bearish view.

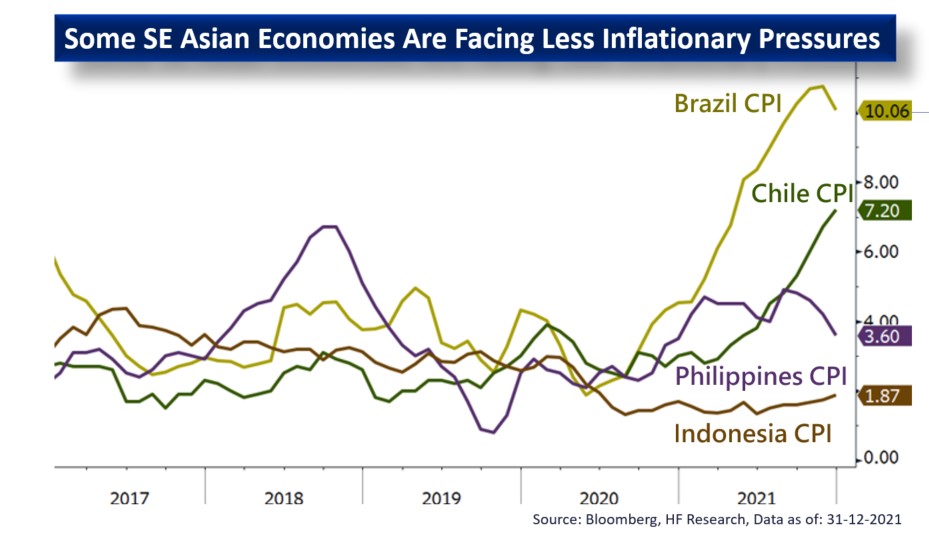

Inflation is another drag factor. Global monetary policies are starting to tighten in response, with a stronger Dollar due to rising yields. This do not bode well for EM equities, as a strong Dollar tends to impact EM equity performance. Moreover, EM central banks have already hiked rates over the year to deal with their own inflation, but these could damage the local economy, as tightening monetary conditions tends to hinder economic recovery. With these macro backdrop factors not dissipating anytime soon, we maintain our conservative view on EM equities in 2022, only staying selectively opportunistic on China which is covered in the other section, and certain Southeast Asia markets which have better pandemic control and are facing less inflationary pressure.