A-shares were less affected by the external markets and bounced back from January losses. That said, headwinds still remain, economic fundamentals are soft, and policy uncertainty has not completely dissipated.

Over the month of February, CSI 300 Index edged 0.39% higher (1.22% in US$ terms), whereas the Hang Seng Index fell in line with external markets, losing 4.58% (4.78% in US$ terms).

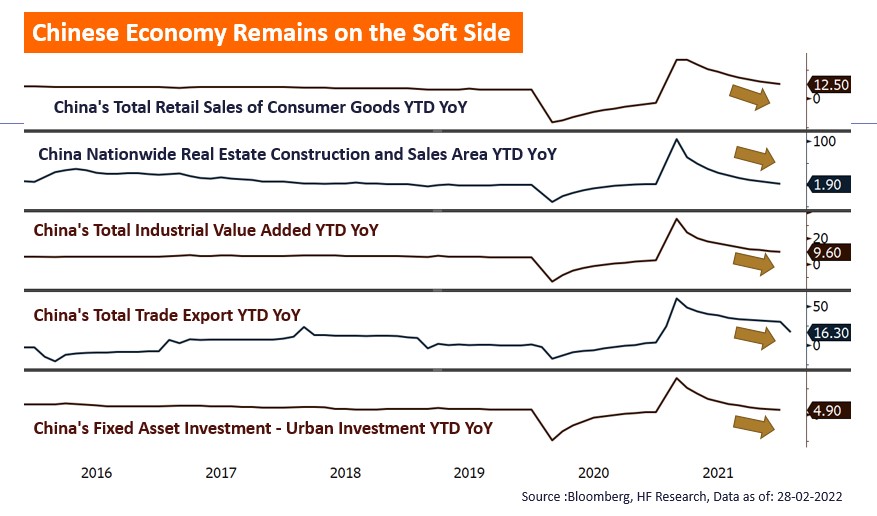

Chinese economy is still on the soft side, as leading indicators have showed. While signals from the politburo have indicated that there should be more support coming from both fiscal and monetary sides, concerns over the real estate market remains. That said, we are still optimistic on the policy outlook, even though the overall economic growth might slow down, as we believe that the authorities’ repeated emphasis on ‘stability’ should still be the overarching policy doctrine for the year, which should reduce chances of any disastrous market crash.

For the outlook of the year, our views on the sectors has not really changed materially, as we are still positive on the selected few sectors, namely new energy and technology related sectors. The renewables related sector should see continued policy support as China continue to move towards its carbon neutral target. Whereas the technology sectors are expected to see valuation recovery as they have good fundamentals and have relatively cheap valuations at the moment. Overall, we are still leaning towards a positive outlook on the Chinese market for the year, as loosening policy stranglehold in the market should help with equity valuation recovery.