European markets were shaken as geopolitical tensions in Ukraine rose. With the energy crisis potentially intensifying due to the ongoing Russo-Ukrainian conflicts, and the numerous subsequent sanctions on Russia, high inflation is likely going to persist. With market sentiment worsened, the European STOXX 600 index fell 3.36% (3.46% in US$ terms) in February.

The Russo-Ukrainian conflict continued, peace talks have not resulted in any meaningful progress. In response, western nations have imposed a fresh round of sanctions against Russian entities, targets included a number of banks and other key institutions, which is expected to cause great damage to the Russian economy. Due to the ongoing conflict and sanctions, expect crude oil supply to tighten, which could further push up energy prices, especially in Europe where there is more reliance on the Russian supply, inflation could remain elevated in Europe.

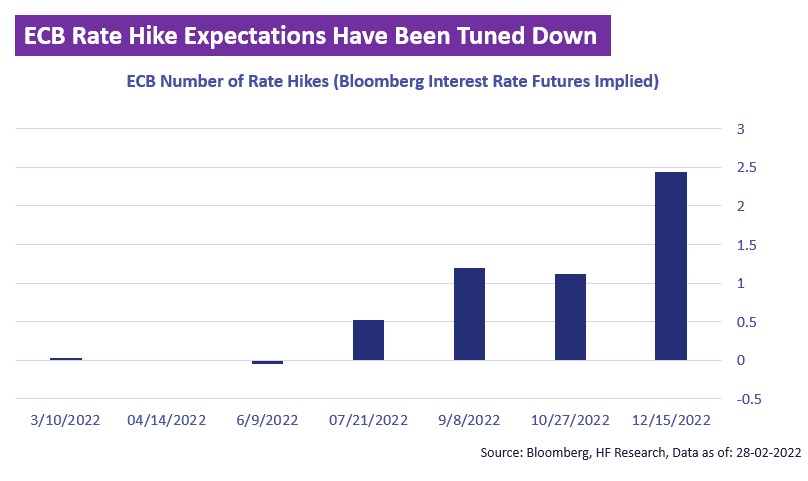

As a result, this could possibly impact the ECB monetary policy. Originally, given the relatively persistent high inflation, the ECB is expected to tighten its monetary policy over the year, cutting down on the scale of quantitative easing, alongside a number of rate hikes. While the higher level of inflation is almost a given fact at this moment, uncertainty surrounding the situation in Ukraine could delay the expected tightening in a bid to relieve short term liquidity squeezes in the market. However, fundamentals are expected to stay weaker do to the external circumstances, and we remain less positive on the European equity outlook before the 2 main risk factors fade out.