Weekly Insight April 9

United States

United States

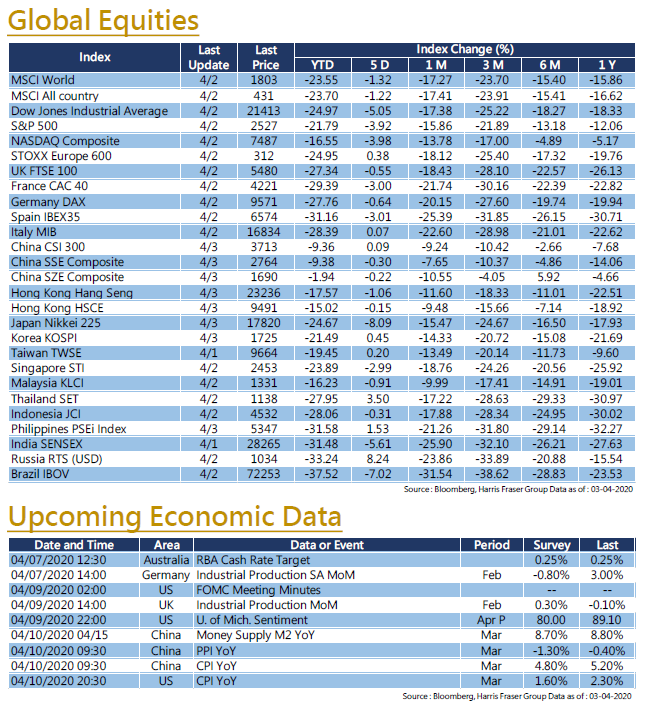

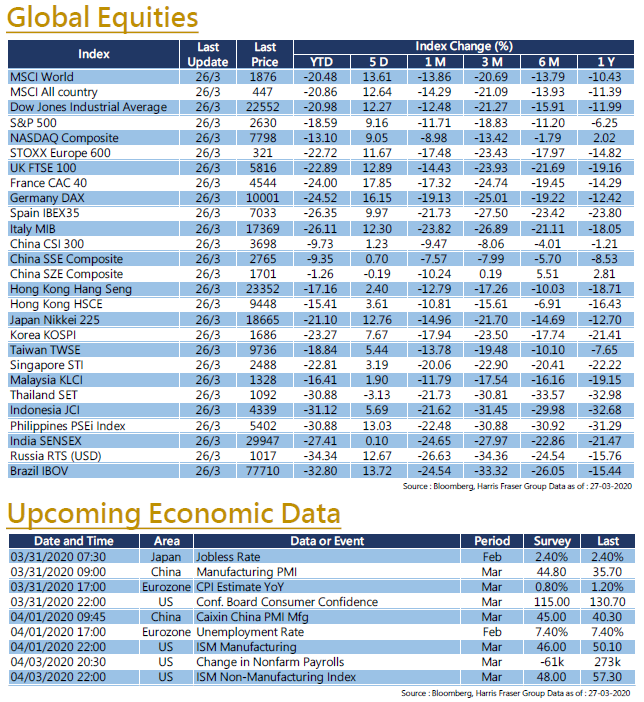

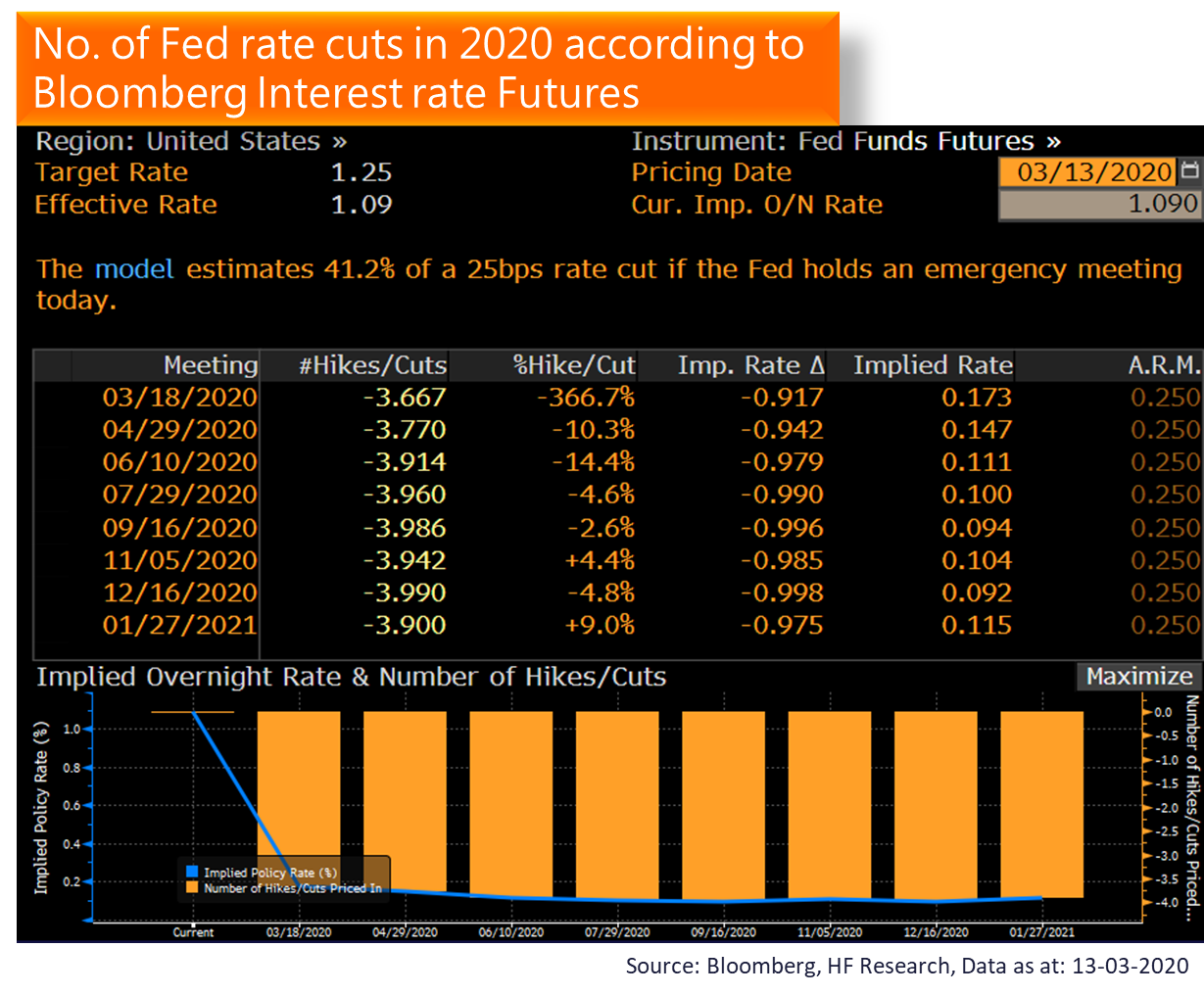

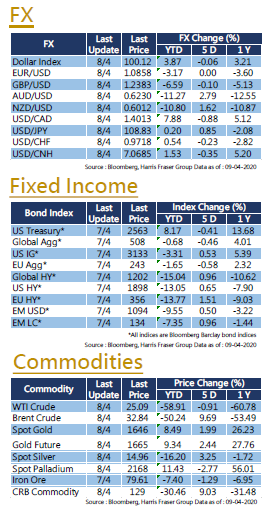

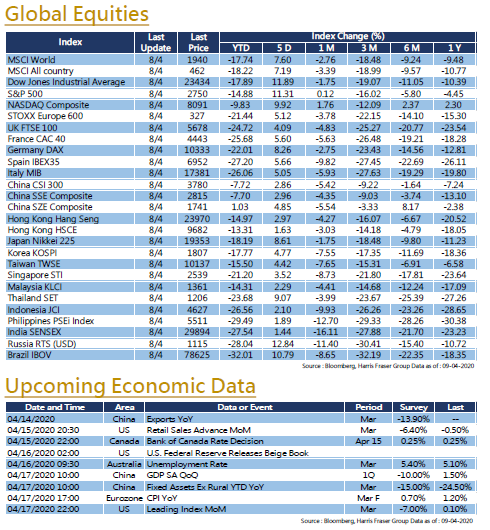

Recently, the situation in many epidemic-hit areas in Europe and the US have shown signs of easing, and global stock markets reacted and rebounded. Over the past 5 days ending Wednesday, the three major US stock indexes rose 10%. Although the covid-19 death tolls in New York and New Jersey have reached new record highs, the US government hopes that the country’s economy will resume to normal within four to eight weeks, public health specialists in the White House Public Health team are drafting a plan to safely reopen after the lockdown. In terms of monetary policy, the minutes from the Fed’s March meeting showed that the Fed was using emergency interest rate cuts to buy time for studying the feasibility of launching of new tools. US Treasury Secretary Mnuchin mentioned that the Fed will launch a loan programme for medium-sized enterprises this week to support them during the epidemic. There have been new developments in the US elections, and aspiring president candidate US Senator Bernie Sanders ended his presidential campaign, which means that former vice president Joe Biden will likely become the Democratic Party’s presidential nominee. Survey showed that Biden is expected to defeat Trump in a 49% to 41% vote. As for crude oil market news, OPEC + will hold an emergency meeting on Thursday to discuss production cuts, it was reported that Russia is preparing to cut crude oil production by 1.6 million barrels per day, the market will keep an eye on the oil price. Next week, the US will announce retail sales, economic leading index and the Beige Book.

Europe

Europe

With the growth of new cases slowing down, Italy and fellow countries are considering to relax their lockdown measures, Germany also began discussions on uplifting epidemic response measures. Over the past 5 days ending Wednesday, the UK, French and German stock indexes have rebounded about 4-8%. It was reported that the European Commission is looking at a coordinated approach to formally uplift the lockdown measures across the region, it is expected that the details will be announced after Easter. As for the UK, it was reported that the condition of the Prime Minister Boris Johnson, who is still in the intensive care unit, has improved. However, the outbreak in the country is still severe, and the daily number of covid-19 deaths has also set record highs. An official reckoned that the UK may extend its lockdown measures for another several weeks. The market will pay close attention to the European epidemic situation and the news on uplifting lockdown measures.

China

China

This week, Chinese and Hong Kong stock markets also made good recovery, but the rebound was slightly less than to European and American peers. The People's Bank of China announced lowering the reserve ratio for small and medium-sized banks in April 2020, releasing a total of about 400 billion yuan in long-term funds. Starting from Tuesday, the interest rate of excess deposit reserves of financial institutions in the central bank will also be lowered from 0.72% to 0.35%. Market expects that relevant measures will offer targeted help to small and medium-sized banks and enterprises affected by the epidemic. Hong Kong has also announced an epidemic relief plan of HK$ 137.5 billion, which is positive for market sentiment. In terms of economic data, China's foreign exchange reserves fell by US$ 46.1 billion in March, which is the largest decline in more than three years. China will release data such as 2020 Q1 GDP and fixed investment figures next week.

- Recent activities include : Harris Fraser held a Press Conference on “2020 Global Investment Market Outlook”, Attended Bloomberg Businessweek/Chinese Edition Top Fund Awards 2019

- Columns, media interview and online channels : “TVB News”,“TVB Big Big VIP”, “Now FINTERVIEW”, “iCable Finance”, “iCable News”, “Capital”, “Edigest”,“SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”, “Business Times”,“OrangeNews”, “Quamnet”,” stockviva”and online videos produced by Harris Fraser Group. (including but not limited to the above)