Weekly Insight November 1

US

US

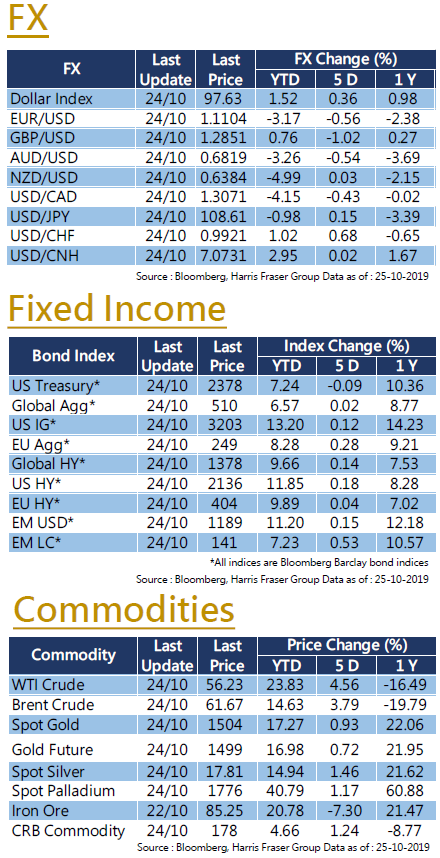

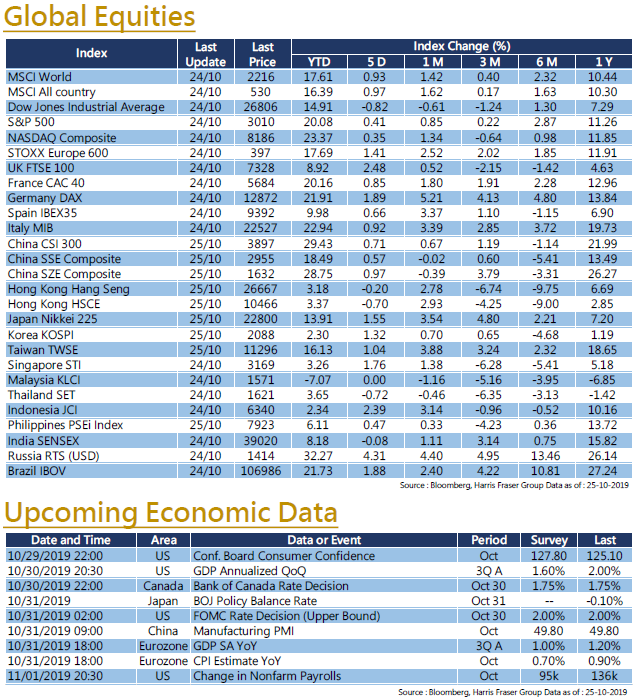

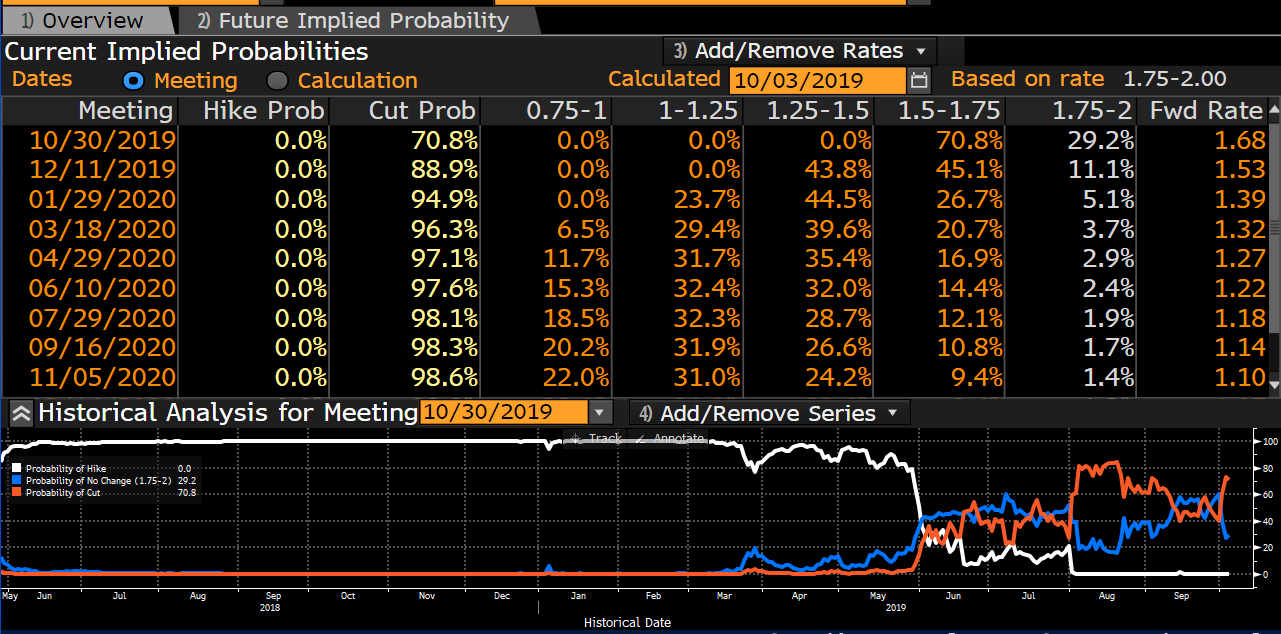

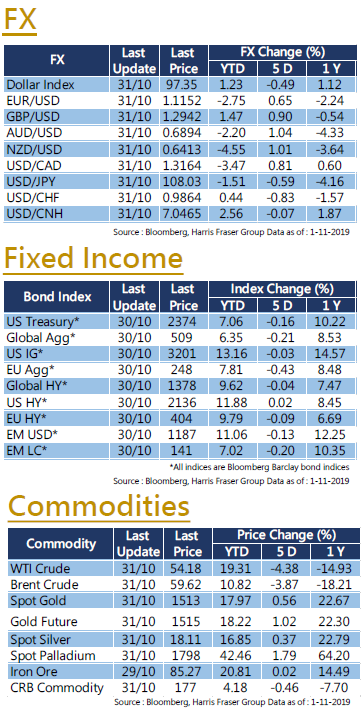

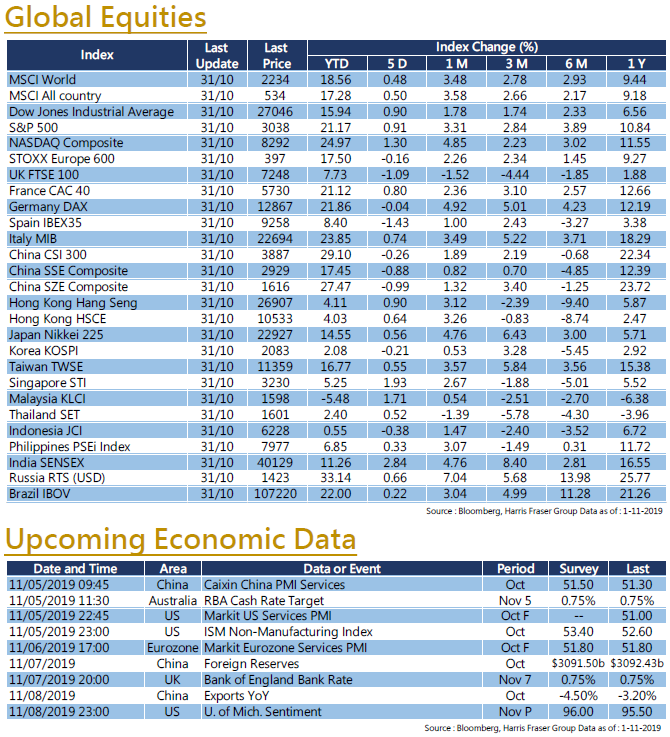

The US corporate earnings period is slowly coming to an end. Among the 347 index constituents that have announced their Q3 results, more than 80% outperformed market expectations, and the overall market recorded a slight earnings increase YoY. Apple's quarterly results and sales exceeded market estimates, propelling the stock price upwards, and providing support to the tech sector. Coupling this with the better than expected US economic data, the S&P 500 hit a record high. Over the past 5 days ending Thursday, the Dow and S&P 500 gained 0.9%, while the tech based NASDAQ recorded a more significant increase of 1.3%. The FOMC meeting was held this week, interest rates were cut by 25 basis points as the market expected. The Fed Chairman Powell said that as long as inflation stays low, the Fed will not raise interest rates. According to the Bloomberg interest rate futures data, the probability of a rate cut in December has decreased to around 20%, which means that there is a low chance of another rate cut in 2019. In terms of economic figures, driven by strong consumer spending growth, the US GDP grew at an annual rate of 1.9% in Q3, surpassing the market expectation of 1.6%. US employment data will be released tonight, and we will get more data like services PMI next week.

Europe

Europe

As the Pound regained strength, the Pound denominated UK stock market fell under pressure, the UK FTSE 100 index fell more than 1% over the past 5 days ending Thursday, while the pan-European STOXX 600 index fell 0.16%. In the UK, after Prime Minister Boris Johnson accepted the EU's proposal to postpone the Brexit until 31st January 2020, the House of Commons approved to hold the general election on 12th December. With worries of a “No-deal Brexit” slowly ebbing out, the Pound regained strength and GBP/USD rebounded near the 1.30 level. In terms of economic data, the Eurozone's Q3 GDP rose 0.2% QoQ, outperforming expectations, while the October CPI rose 0.2% MoM, which was slightly higher than the expected 0.1%, indicating that the overall economic environment might have improved. The Bank of England will hold a meeting on interest rates next week.

China

China

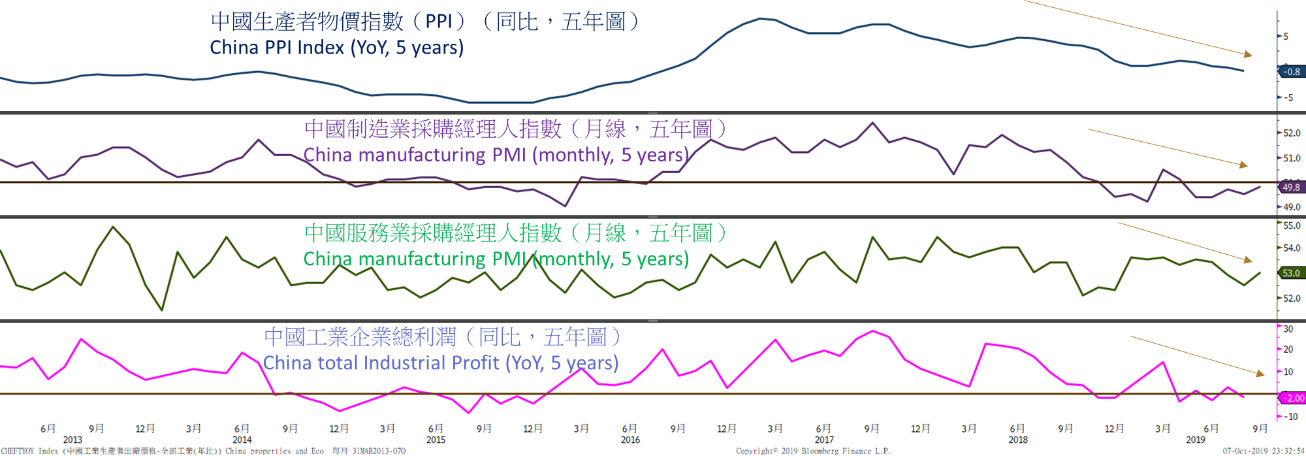

As for China and Hong Kong markets this week, Hong Kong stocks posted a strong performance, while the mainland stocks underperformed. Over the past 5 days ending Thursday, the Hang Seng Index gained nearly 1%. At the beginning of this week, US President Donald Trump claimed that the Sino-US trade negotiations were progressing faster than planned. Unfortunately, the APEC summit was canceled by Chile, there are worries that the two powers might be unable to sign the first stage of the trade deal due to the cancellation. Trump later reassured that both sides are looking for new locations for the sign off. As we continue to get mixed signals from the official and Caixin manufacturing PMIs released this week, the foreign exchange reserves, import and export data releasing next week might offer a better insight into the economy.

- Recent activities include : Attended The Private Wealth Asia Forum, Harris Fraser Hong Kong Property Market Outlook and Investment Strategy Seminar and Press Conference, Taiwan Immigration Seminar etc.

- Media include : SCMP、imoney、AAStocks、TVB、HKEJ、MingPao、HKET、Metro Broadcast、Commercial Radio Hong Kong etc (including but not limited to the above)

- Publishing on newspapers, magazines and online sections : “Capital”, “SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”, “OrangeNews”, “Quamnet” and online videos collaborated by Mason Securities limited and Harris Fraser Group.