European markets continued to stay strong despite volatility in the rest of the world, market sentiment remains positive with various positive factors continue to support the short to mid-term outlook. The European STOXX 600 index gained 1.97% (2.05% in US$ terms) over the month of July.

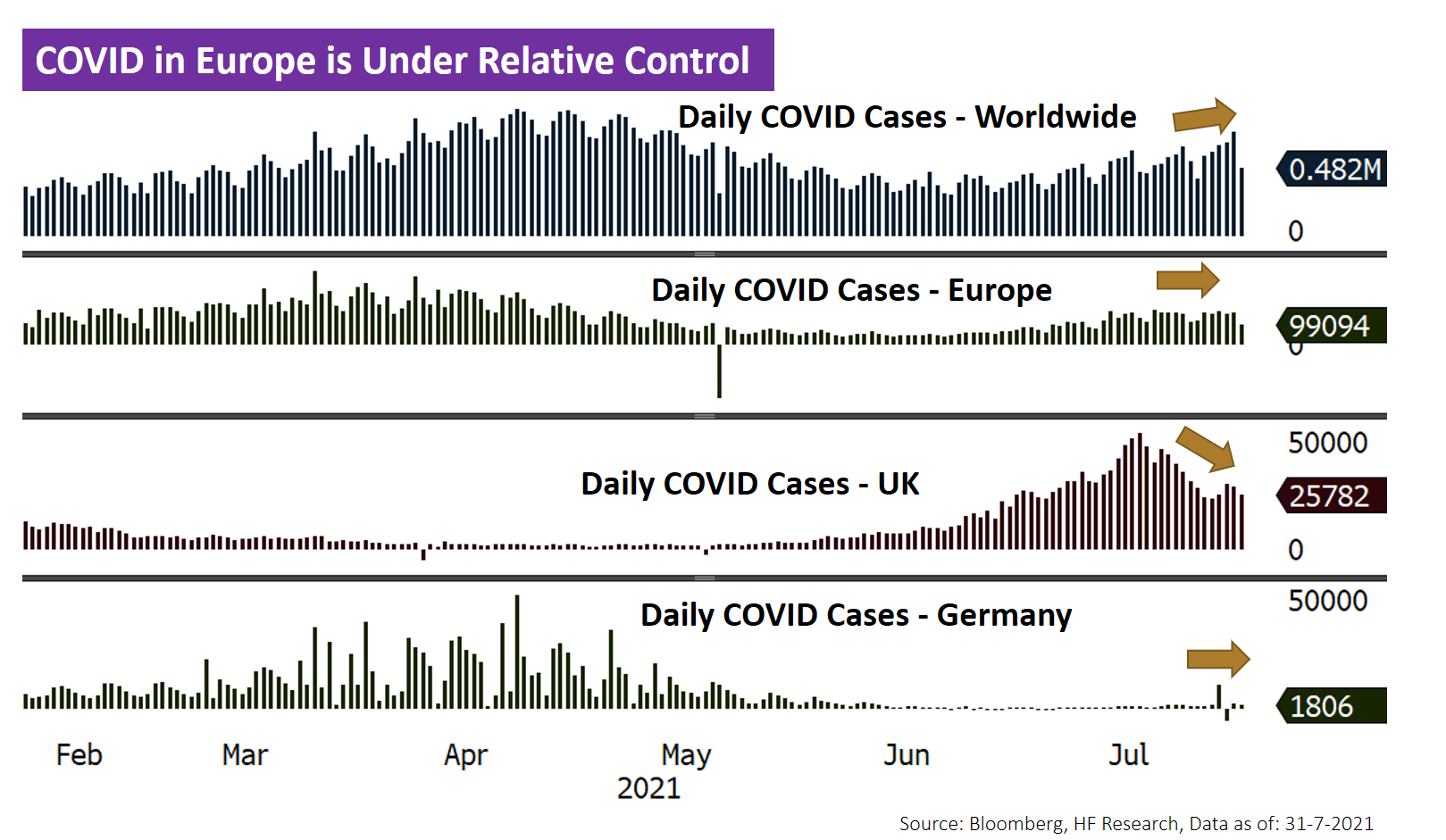

Economic fundamentals in Europe continue to stay strong. Various PMIs stay close to the all-time high, reflecting the positive business environment at the moment, sentiment indicators such as economic sentiment and consumer confidence indicators are also positive, staying above the long term average. With the continued vaccination efforts, epidemic restrictions in the region should likely follow the UK path and be uplifted. Overall, we expect the outlook of the European economy to stay on the positive note as risks such as COVID fade out.

Apart from a good control over the COVID epidemic and a solid economy, the European market also has a particular advantage in terms of monetary support. With the inflation level lower than most major economies, the ECB have announced no change to rates and the PEPP after the latest interest rate meeting, and further changed the inflation targeting to ‘symmetric 2% inflation target’. These would further cement our idea that there will be no tapering before Q2 2022, and no rate hikes in the short to mid-term. Henceforth, the monetary policy should remain more supportive compared to most other major economies, we continue to hold a positive outlook on the European market in the coming few months.

US

US Europe

Europe China

China