US

US

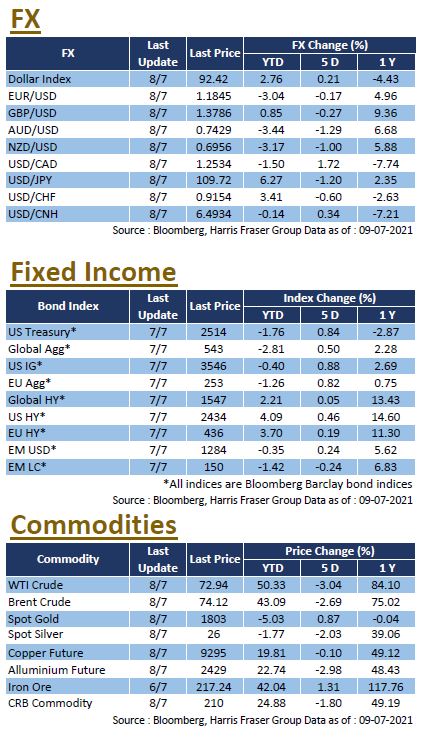

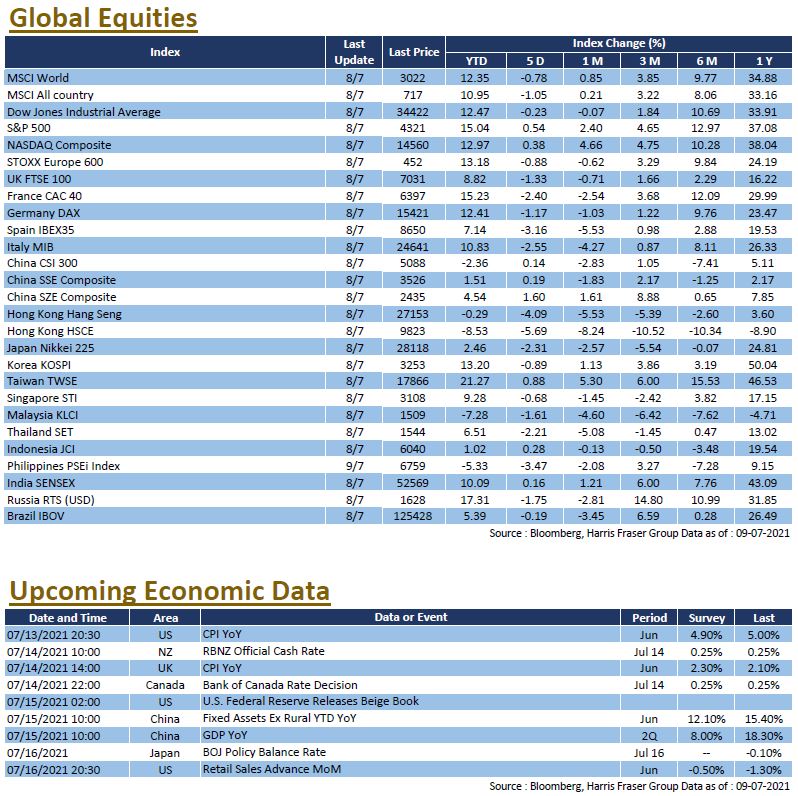

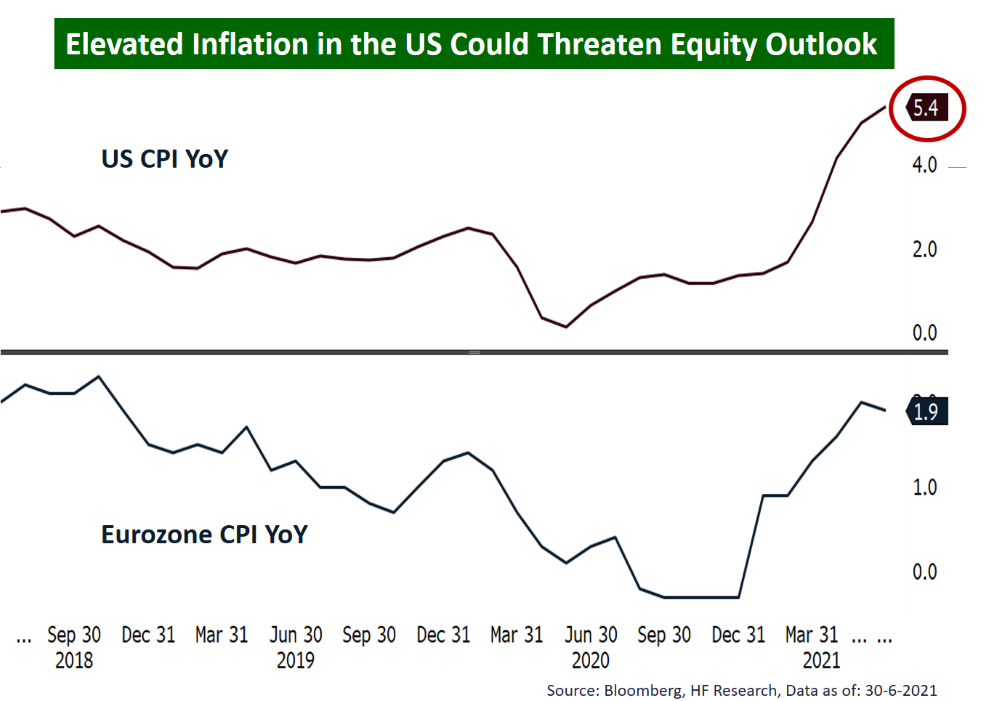

US stocks erased much of their previous gains on Thursday alone, amid concerns that the US economic impetus may be slowing down. In spite of the Thursday drawdown, US stocks still outperformed the other major equity markets over the past five days ending Thursday, with the S&P 500 and NASDAQ up 0.54% and 0.38% respectively. On the US data front, the labour market continued to improve, with a record number of 9.2 million job openings in May, reflecting further strengthening of the job market. However, the pace of expansion in the US service sector, reflecting service sector activity, was weaker than expected in June, raising concerns that the US economic growth momentum may have peaked, triggering a market correction. Longer-term inflation pressures have eased as the 30-year US Treasury yield, typically reflecting longer-term inflation expectations, fell to 1.85%, down 66 basis points from its high of 2.51% in March. The minutes of the June meeting of the US Federal Reserve showed that officials expect the timing of the tapering could be earlier, but remain divided on how to scale back purchases of mortgage-backed securities (MBS).

Global oil prices continue to rise, mainly due to concerns over the supply outlook as Saudi Arabia and the UAE failed to reach an agreement on increasing production. No announcement has been made regarding the next OPEC+ meeting, which may mean that production will probably stay unchanged in August, possibly resulting in a 'historic supply gap', and this has spurred a further rise in oil prices to near US$77 per barrel. The market is still closely monitoring oil price action. Next week, the US will release important data such as CPI and retail sales for June, and the Fed will also publish its latest economic beige book.

Europe

Europe

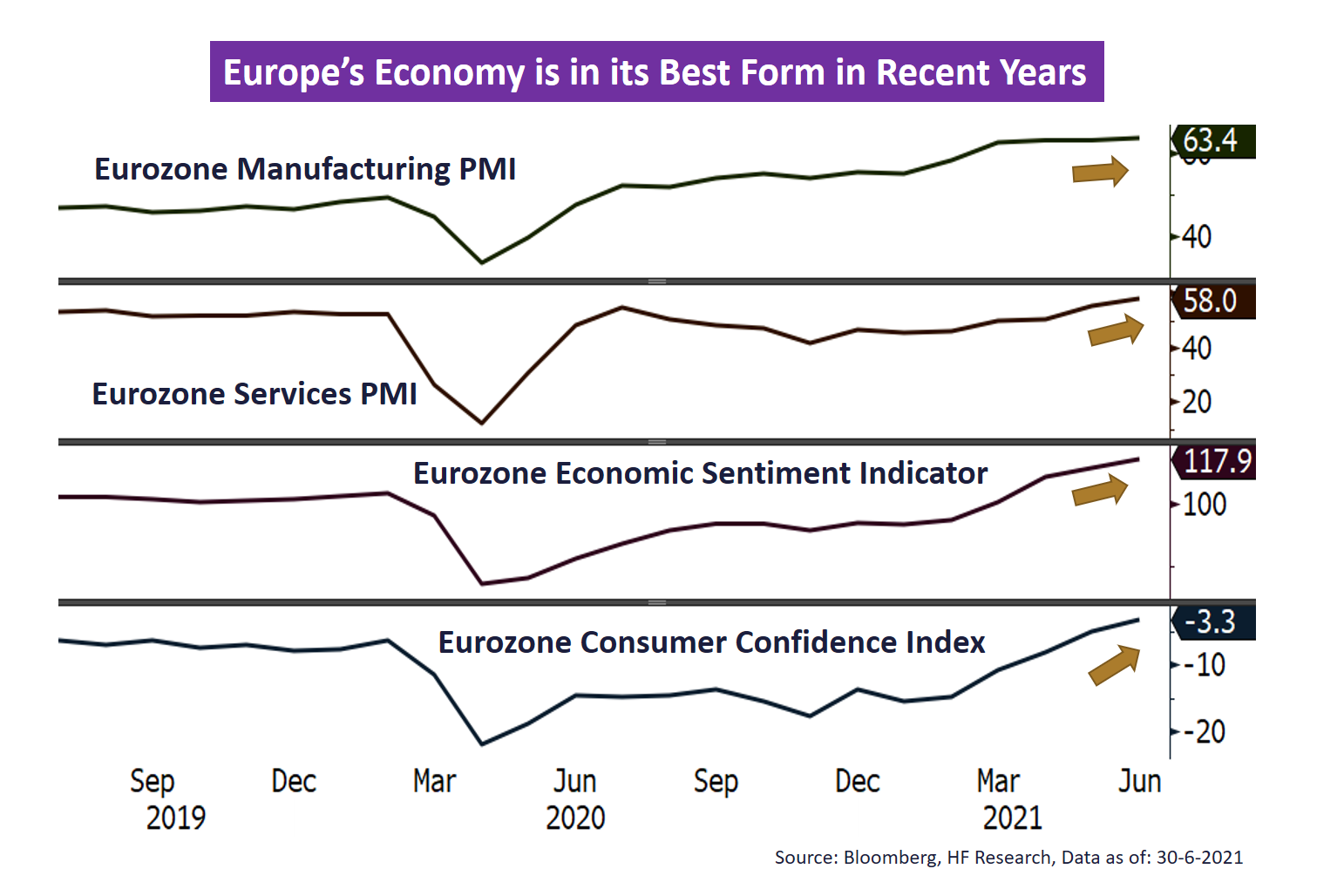

European stock markets have been weak recently, with the UK, French, and German equity indices down 1.33%, 2.40% and 1.17% respectively over the past 5 days ending Thursday. The ECB announced the results of its first strategy review since 2003, stating that a medium-term "symmetric" inflation target of 2% will be implemented from 22 July onwards, while allowing inflation to "moderately" exceed this level temporarily. ECB president Christine Lagarde said that the new inflation target does not preclude any potential policy tightening, which was unanimously agreed by central bank policymakers. On the other hand, the European Commission raised its economic growth forecast for the Eurozone from 4.3% to 4.8% this year, saying that the economy is "recovering strongly". Next week, the UK will release CPI data for June.

China

China

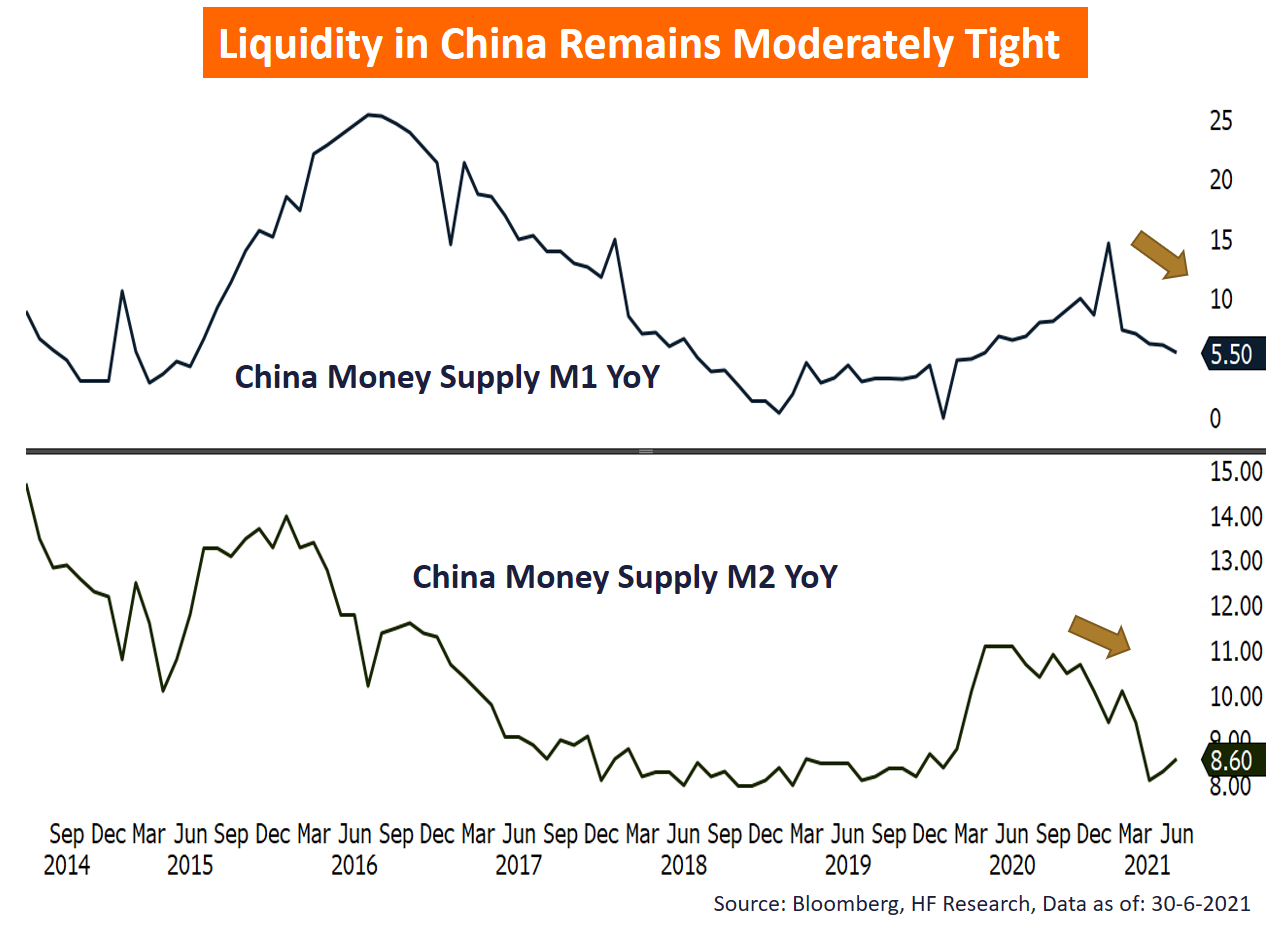

The investigation of DiDi has renewed regulatory concerns in China, and the sharp fall in China concept stocks weighed on the performance of the Hong Kong stock market. The Hang Seng Index was down 3.41% for the week, while the mainland stock market fared better, the CSI 300 Index was slightly lower by 0.23% for the week. The freshly US-listed vehicles for hire leader DiDi is under investigation, with its share price falling by nearly 20% in a single day after its IPO, and its shares have been in a downward spiral since then, to the extent that US investors have taken it to court. It is reported that the Chinese government may tighten up the supervision of companies listing abroad. On the other hand, China's bond market was supported by the State Council's reintroduction of "timely RRR cuts", which saw the 10-year bond yield briefly falling below 3%. Next week, China will announce its GDP for the second quarter and important data on fixed investment, production and retail sales in June.

US

US Europe

Europe China

China