US

US

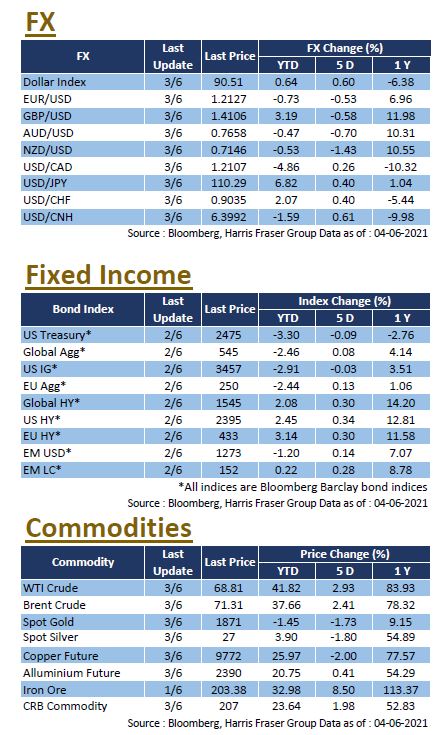

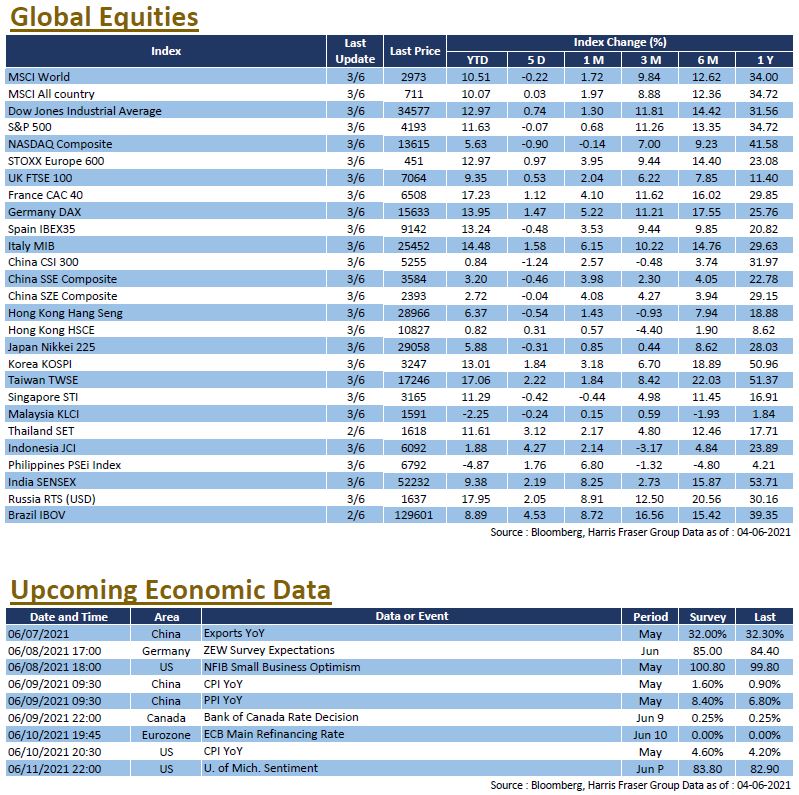

The latest economic data were very encouraging, but talks of inflation weighed down on markets, as fears of monetary tightening led to the continued downward pressure on the tech sector. Over the past 5 days ending Thursday, only the cyclical heavy Dow Jones managed to post a gain of 0.74%, while the S&P 500 and NASDAQ fell 0.07% and 0.90% respectively. The US released a number of important data over the week, headline figures for sentiment indicators and employment data were all positive, services PMI in particular hit a new record high of 70.4, initial jobless claims also dropped below the 400k level for the first time since the epidemic has started. All the positive economic indicators point to a strong recovery in the economy, reports that President Biden is considering shelfing tax hike plans further supported equity performance.

However, worries over inflation rose, the possible tightening up on liquidity in the future put more pressure on the growth heavy tech sector. Philadelphia Fed chair Patrick Harker recently mentioned that it is about time to think about tapering talks, echoing the two Fed vice chairpersons’ view, implying that the current easy monetary policy could possibly see an earlier than expected adjustment. In other news, the gold rally hit the brakes, seeing a 1.45% drop on Thursday. Next week, more data will be released, NFIB Small Business Optimism and University of Michigan Sentiment could further reaffirm the current business conditions, while any surprises in the CPI data for May could have implications for the monetary direction.

Europe

Europe

European market sentiment stays positive with its favourable economic outlook, and the supportive central bank policy tone buoyed European markets. Over the past 5 days ending Thursday, the UK, French, and German equity indexes were up by 0.53 – 1.47%. Data wise, Europe is still doing great, PMI figures across European countries were great, employment data was also positive. More importantly, while inflation jumped to 2.0% in the region, the figure remains roughly in line with central bank targets, fears of liquidity tightening or even rate hikes were still mostly out of the picture. ECB chairperson Christian Lagarde said that the Bank will keep policy support in place ‘well into the recovery’, market expects that the ongoing Pandemic emergency purchase programme (PEPP) will be kept in place well into next year. Next week, Germany will release its latest ZEW survey expectations, while the ECB will hold its June interest rate meeting, expect to hear more on the PEPP plans for the remaining half of the year.

China

China

Chinese equity markets were relatively muted over the week, as the latest economic data coming out of the country were mixed, tight liquidity conditions in the onshore markets also limited valuation expansions. The CSI300 and Shanghai composite were both down over the week, while the HSI was also dragged by the volatile markets and was down by 0.71%. It was reported that China is considering a cut in stamp duties, the equity market rebounded on Friday upon the news. However, this is still not enough to reverse the recent falling trend. Economic data this week had one surprise, as the official manufacturing PMI fell short of expectations, coming in at 51.1, whilst other figures remained in the expansionary zone. Next week, China will release figures on CPI, PPI, and exports.

US

US Europe

Europe China

China