United States

United States

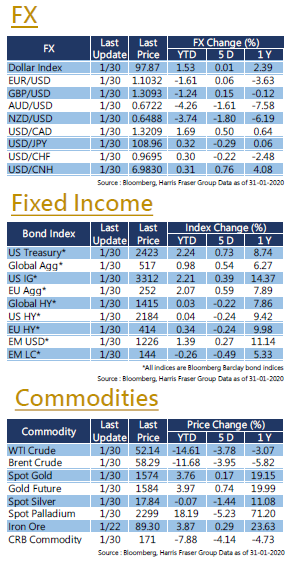

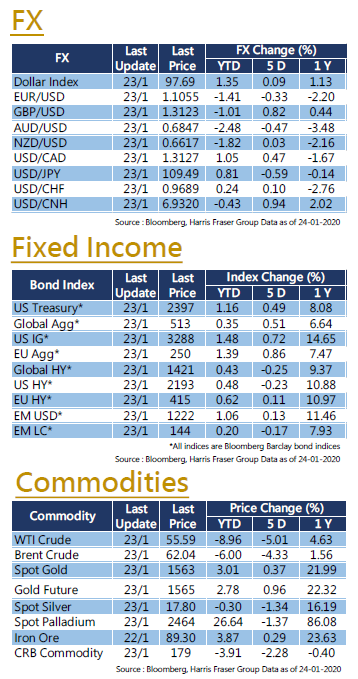

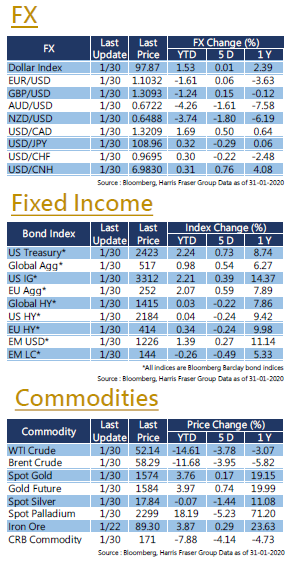

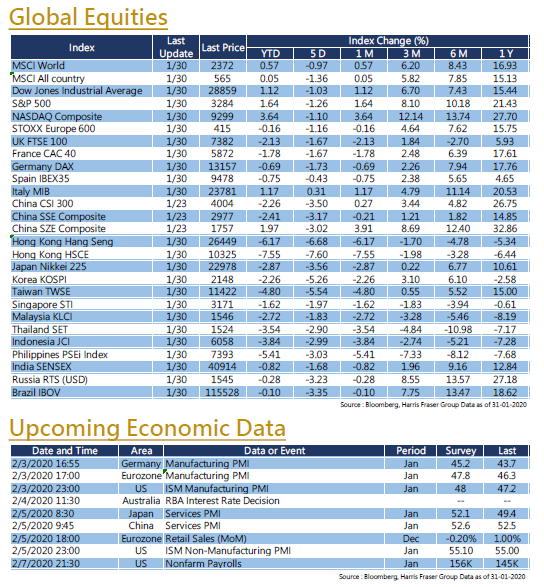

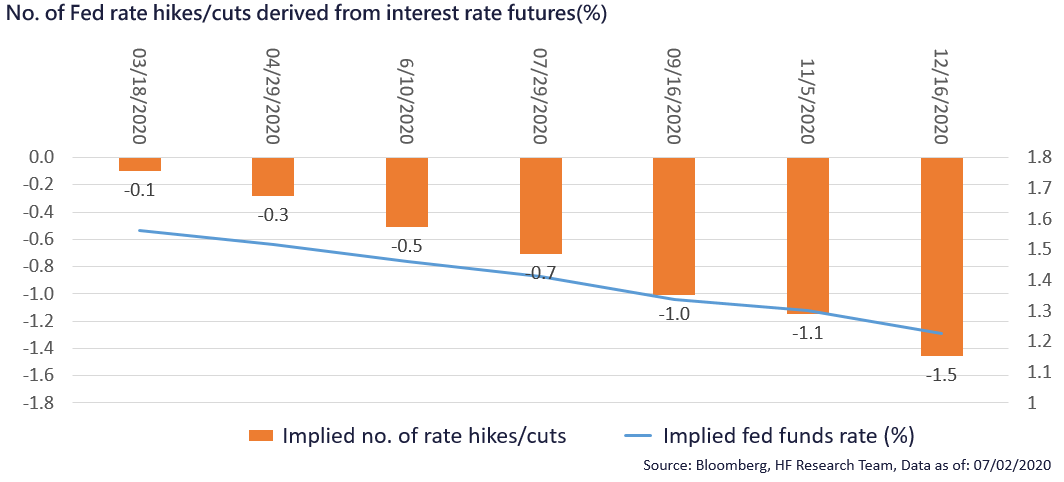

The novel coronavirus pneumonia continued to rage across the globe. According to China officials and the World Health Organization (WHO) data, confirmed cases have exceeded 9,800 with more than 210 deaths. The WHO has decided to list the new pneumonia epidemic as a Public Health Emergency of International Concern. The global spread of the epidemic drove up anxiety in the investment market, we saw a slight correction in US equities earlier in the week, but the Indices managed to rebound on Thursday as corporate earnings surpassed market expectations. Major technology giants, including Amazon, Facebook, Apple, and Microsoft alike, announced their latest quarterly results this week, all of them beat market estimates, Paypal, MasterCard and Tesla also reported earnings beat. The US Federal Reserve announced no change in interest rates after the FOMC meeting, in line with market expectations. The FOMC policy statement claimed that the current inflation remains low and the economy is still growing at a "moderate rate". US economic data this week was satisfactory, as the 2019 Q4 GDP growth of 2.1% was slightly better than market expectations of 2%. Next week, US January data on ISM manufacturing and non-manufacturing PMI, non-farm payroll data alike will be released.

Europe

Europe

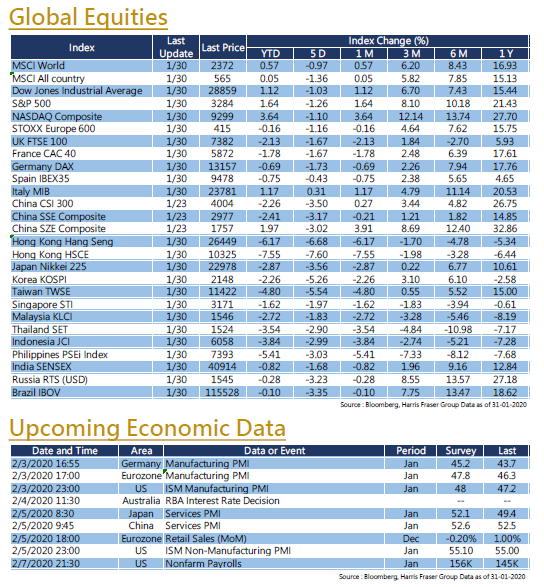

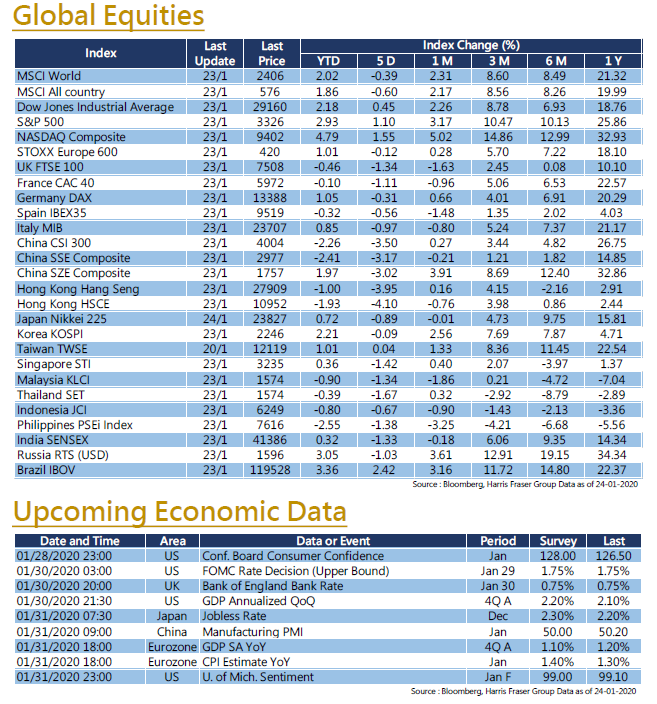

European stock markets declined over the week; the German DAX index fell 1.7% over the past 5 days ending Thursday. The Bank of England kept interest rates unchanged at 0.75% as expected, the Bank also maintained the same asset purchase scale. After the meeting, the Bank lowered its economic growth forecast, reducing the GDP growth forecast for 2020 from 1.2% in November 2019 to the current 0.8%. In addition, the central bank expects CPI to stay below the 2% target level until the end of 2021. Carney pointed out that British economic activity has increased significantly, and the economic growth rate in the first quarter of this year could reach 0.2%. If the economic recovery fell in line with expectations, a mild policy tightening might even be needed. On the other hand, the European Central Bank stated that it was ready to take any action on market fluctuations resulting from Brexit. Eurozone and German manufacturing PMI data will be released next week.

China

China

Confirmed cases of the novel coronavirus pneumonia in Mainland continued to increase, Asian stock markets suffered hefty setbacks. After the market opened on Wednesday, Hong Kong stocks plummeted more than 700 points for two consecutive days, totalling to a sharp drop of 5.4% over the period. After approval by the China Securities Regulatory Commission, the mainland stock market decided to extend the Lunar New Year holiday until 2nd February, and only open by 3rd February (next Monday). However, the Chinese economic data released was not excessively pessimistic. China’s manufacturing PMI dropped to 50 in January, a 0.2 drop from last month, in line with market expectations. The non-manufacturing PMI rose to 54.1 over the same period, increasing by 0.6 MoM, which was also better than the market expectation of 53.0. However, in the face of the severe epidemic situation, the offshore yuan (CNH) continued to weaken, falling below the 7 level against the US dollar for the first time this year. Service PMI figures will be released next week.

- Recent activities include : Harris Fraser held a Press Conference on “2020 Global Investment Market Outlook”, Attended Bloomberg Businessweek/Chinese Edition Top Fund Awards 2019

- Columns, media interview and online channels : “TVB News”,“TVB Big Big VIP”, “Now FINTERVIEW”, “iCable Finance”,“iCable News”, “Capital”, “SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”, “OrangeNews”, “Quamnet” and online videos produced by Harris Fraser Group. (including but not limited to the above)

United States

United States  Europe

Europe China

China