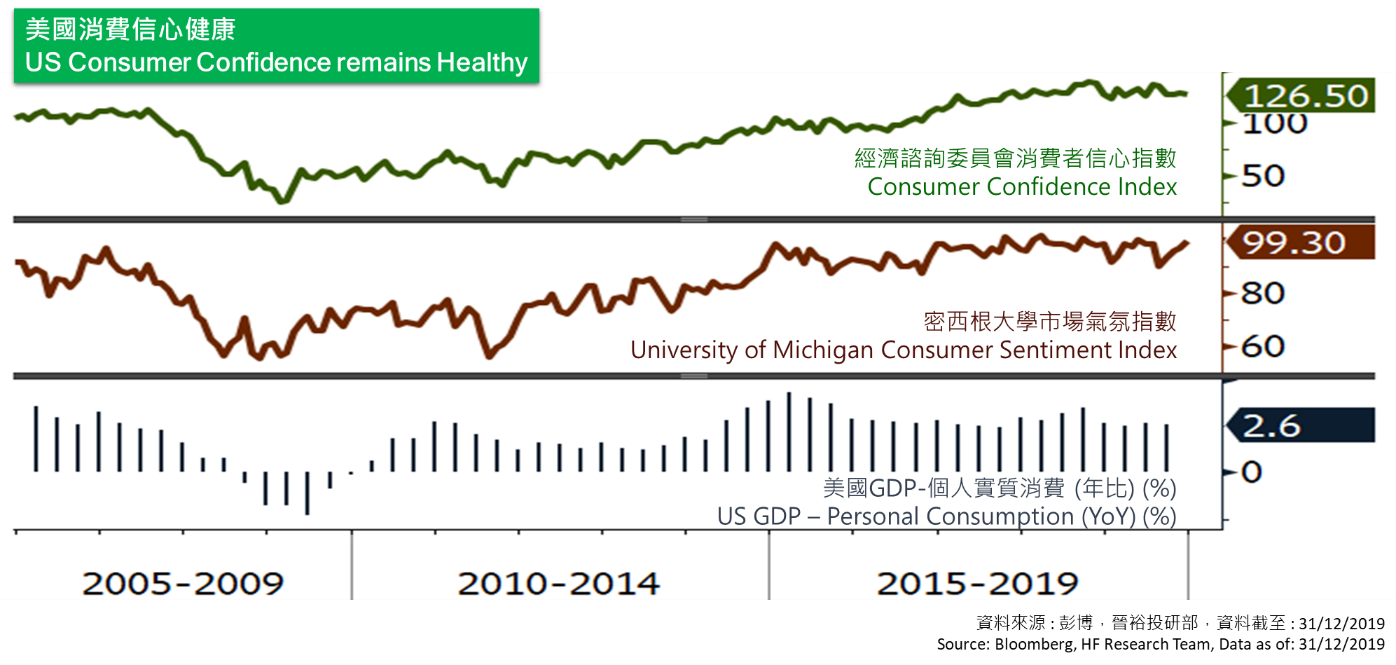

United States

United States

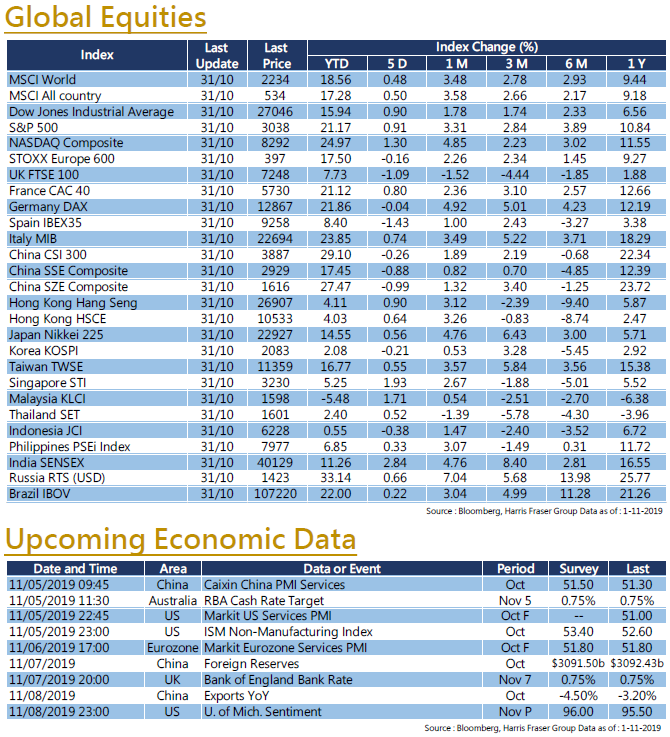

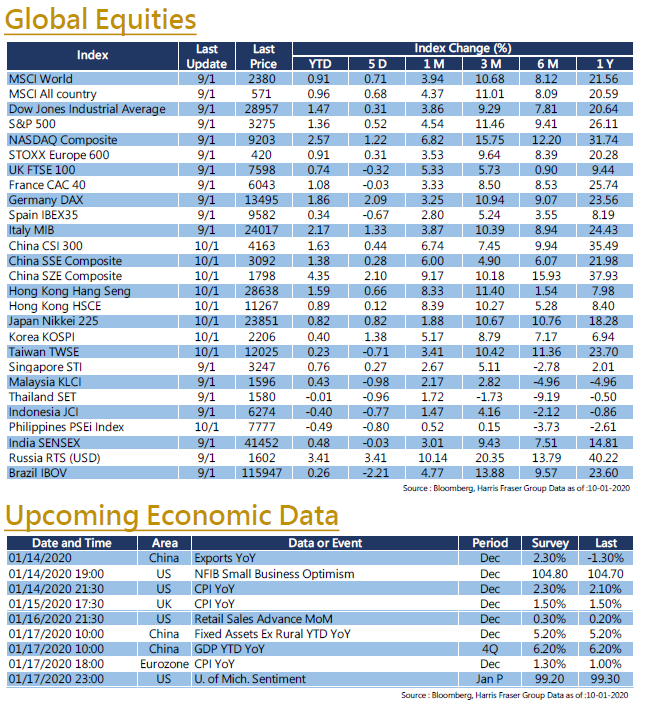

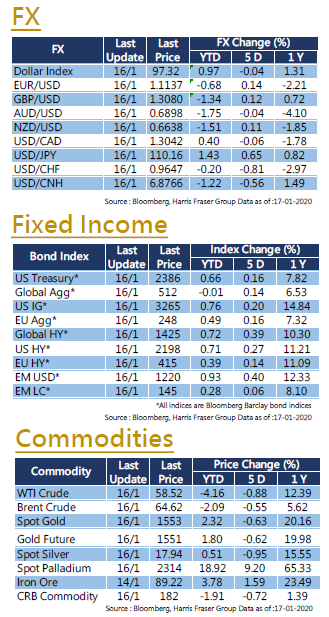

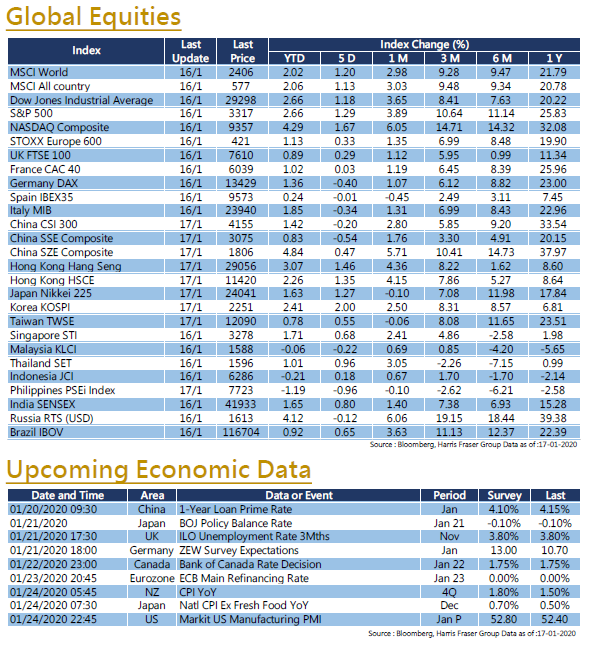

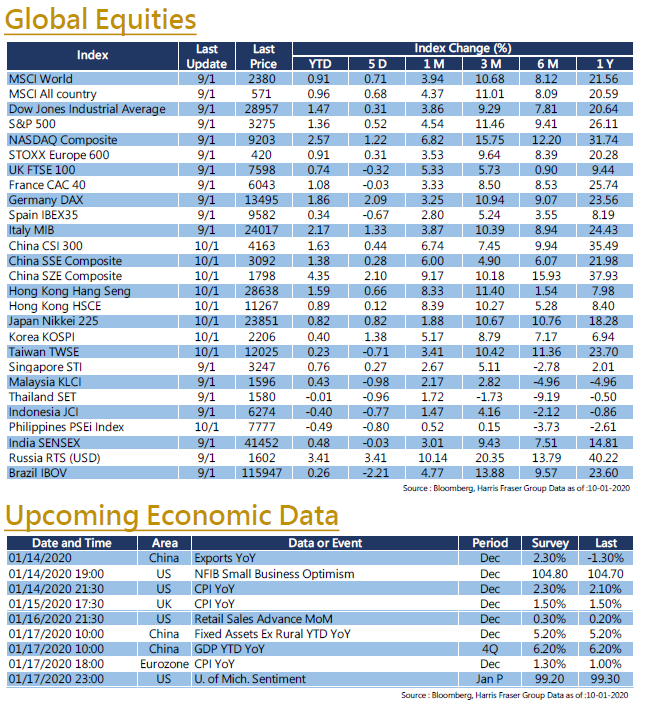

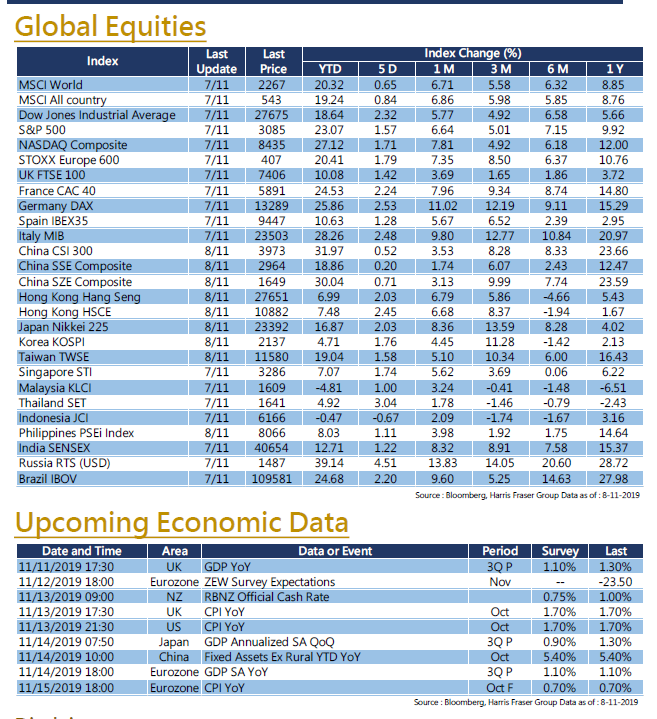

Recently, the situation in the US and Iran came under spotlight, yet US stayed relatively unaffected. Over the past 5 days ending Thursday, the three major US stock indexes rose 0.3% to 1.2%. Although Iran launched rockets and missiles at US bases in Iraq early in the week, in retaliation for the death of the Quds Force commander, the situation in the Middle East showed early signs of de-escalation. The subsequent speech by US President Trump hinted that economic sanctions would be imposed on Iran, but no further military action would be taken. The increased geopolitical risks early in the week triggered capital inflows into safe-haven assets, such as the Japanese yen, gold, and US Treasury bonds.

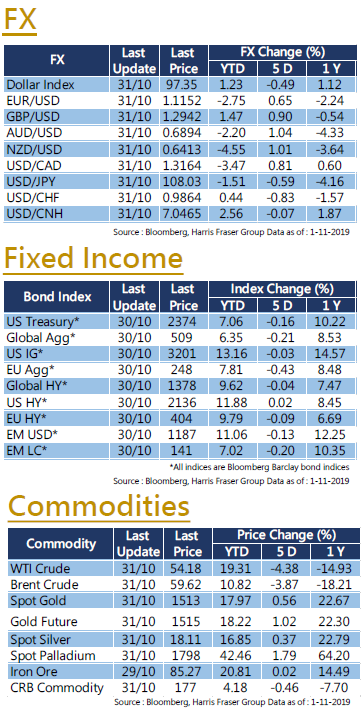

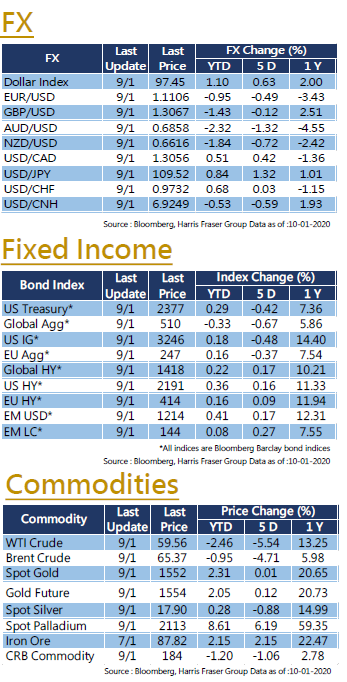

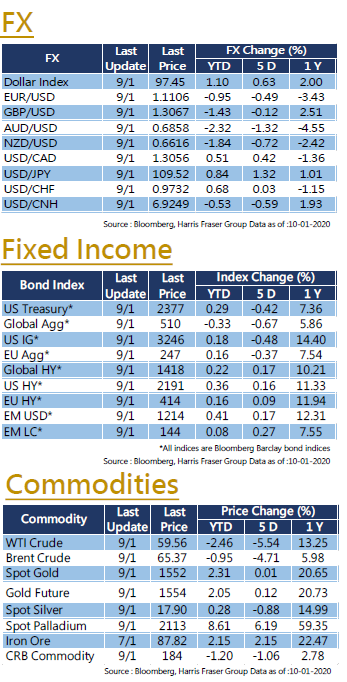

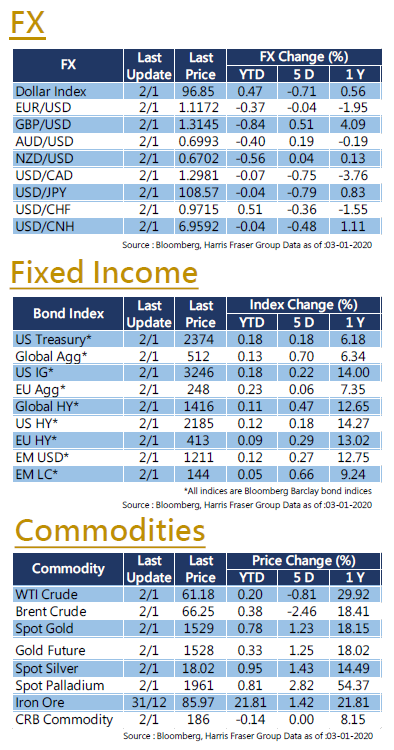

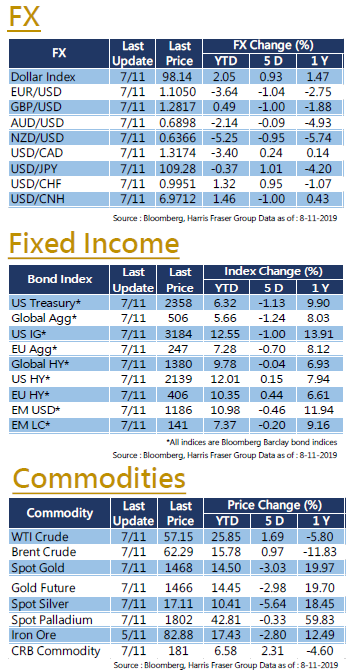

Gold prices also rose to a six-year high. In addition, crude oil prices also benefited from the increase geopolitical risk, with the WTI crude oil breaking through the US$ 65 level. However, as the anxiety ebbed out, the prices of safe-haven assets retreated. At the time of writing, US equities are still hitting new record highs. Next week the US will release December inflation and retail sales data, the US economic outlook and corporate earnings in 2020 will be in focus.

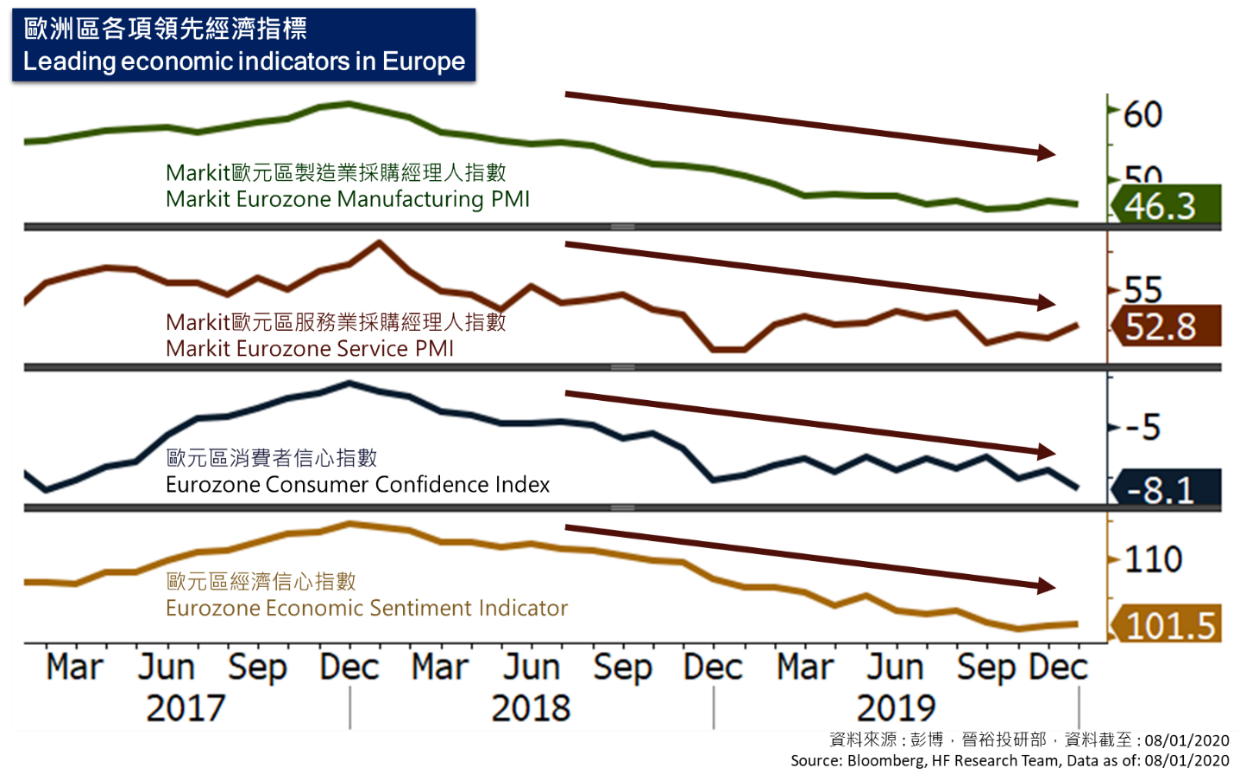

Europe

Europe

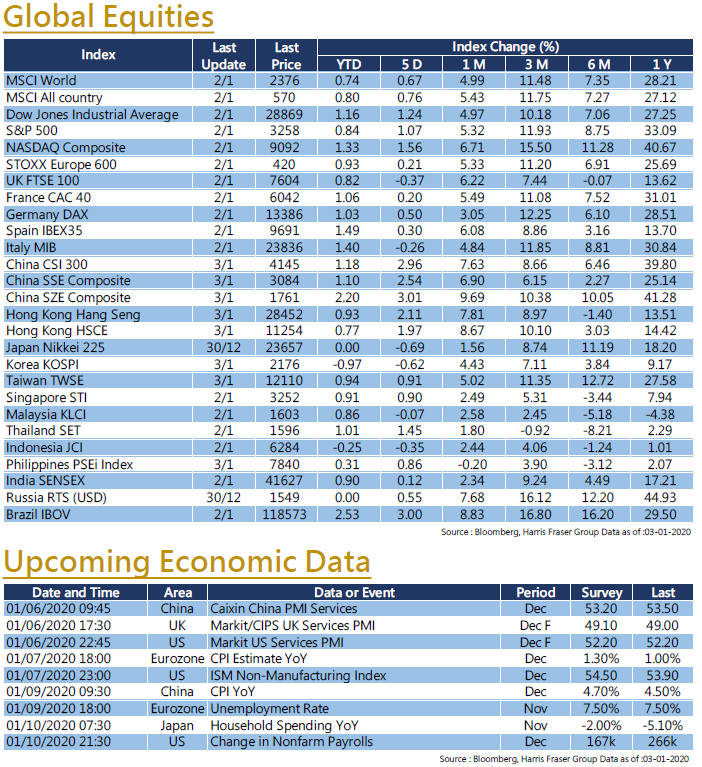

In Europe, the three major indexes had varied performance over the past 5 days ending Thursday. The British FTSE 100 fell 0.08%, the French CAC slightly increased by 0.02%, while the German DAX was further up at 0.82%. In the UK, Prime Minister Boris Johnson’s Brexit agreement was endorsed by the British House of Commons, the Bill has now been submitted to the House of Lords for the final vote, and the market atmosphere has improved. EU officials remained less optimistic over the whole Brexit matter, the EU representative stated that it is unlikely that post-Brexit negotiations on the trade deal could be completed within the 11 months of transition. Regarding the Bank of England’s monetary policy, Governor Carney pointed out that there is still plenty of room for adjustment, this includes “at least doubling” the central bank’s 60 billion pound asset purchase plan in August 2016. Next week, the UK and the Eurozone will release December inflation data.

China

China

As for the Chinese and Hong Kong stock markets, the mainland stock market steadily rose, while Hong Kong stocks have experienced large fluctuations. Due to the turn of events in the Middle East since last Friday, the HSI fell by more than 200 points on Monday. Subsequently, as geopolitical tensions eased, the Index rebounded over the week. Overall, both China and Hong Kong stock markets recorded gains this week. Regarding Sino-US trade relations, Chinese Deputy Prime Minister Liu He will lead a delegation to Washington D.C. to sign the first phase of the trade agreement on the 13th to 15th. Trump said that he would start the second phase of negotiations with China immediately. However, he added that relevant negotiations might drag on well until the US elections are over. China’s December CPI rose 4.5% YoY, which was lower than the original expectation of 4.7%. China will release Q4 GDP, December exports and fixed asset investment data next week.

- Recent activities include : Harris Fraser held a Press Conference on “2020 Global Investment Market Outlook”, Attended Bloomberg Businessweek/Chinese Edition Top Fund Awards 2019

- Columns, media interview and online channels : “TVB News”,“TVB Big Big VIP”, “Now FINTERVIEW”, “iCable Finance”, “iCable News”, “Capital”, “SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”, “OrangeNews”, “Quamnet” and online videos produced by Harris Fraser Group. (including but not limited to the above)

United States

United States  Europe

Europe  China

China

US

US Europe

Europe China

China