Blindsiding the ongoing epidemic, US equities gained in line with global markets. Over the month of May, S&P 500, Dow Jones, and NASDAQ were up 4.53%, 4.26%, and 6.75% respectively.

Even as the epidemic continue to run rampant across the country, numerous states are already uplifting their lockdown measures, including covid-19 epicentres like New York and New Jersey despite continued growing cases. As the global pandemic has lasted for more than 4 months, markets and the society in general have already adopted to the “new normal”, which has minimised the impact to the investment market despite reopening under the “un-flattened curve”.

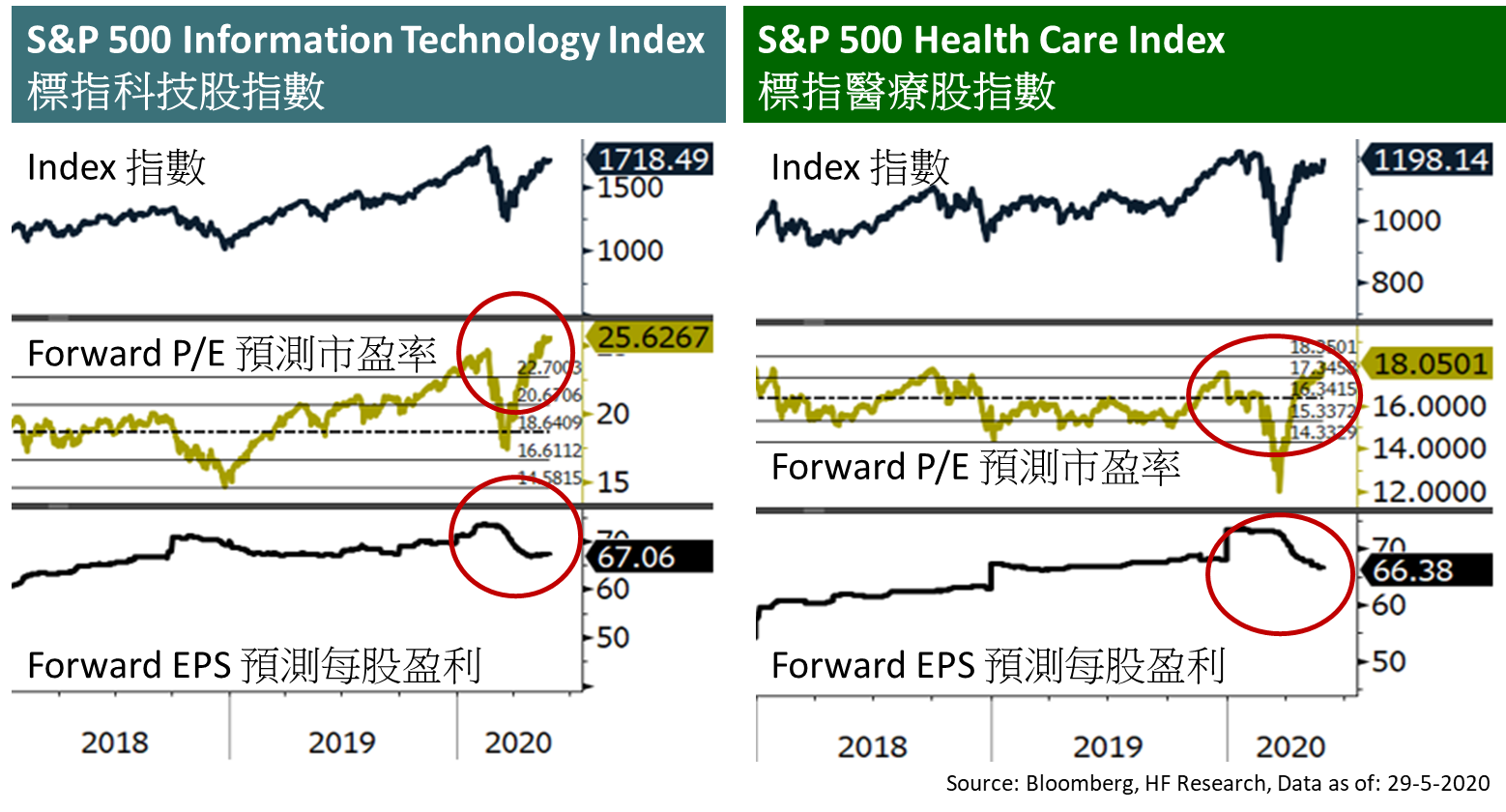

In terms of economic figures, the US outlook are full of uncertainties as we have yet to see a stronger rebound in various leading indicators, PMIs stayed in the contraction zone, while confidence levels remain far lower than previous levels. Despite the weaker fundamentals, we see 2 main reasons for the stock market to continue its strong performance: anticipation of economy restarting, plus excess liquidity flooding the capital markets. In particular, we stay positive on technology and healthcare sectors, as they remain robust with minimal levels of earnings revised, further bolstered with the prospects of long term structural growth.

<Harris Fraser Research Team>