Weekly Insight April 24

US

US

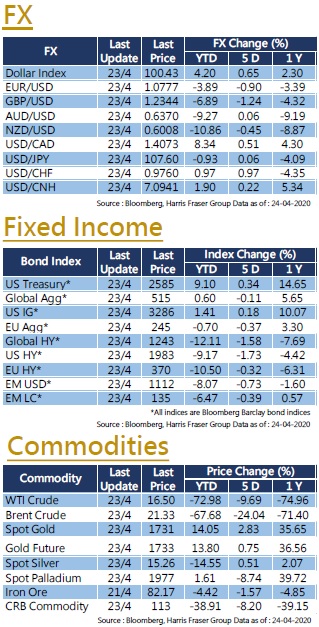

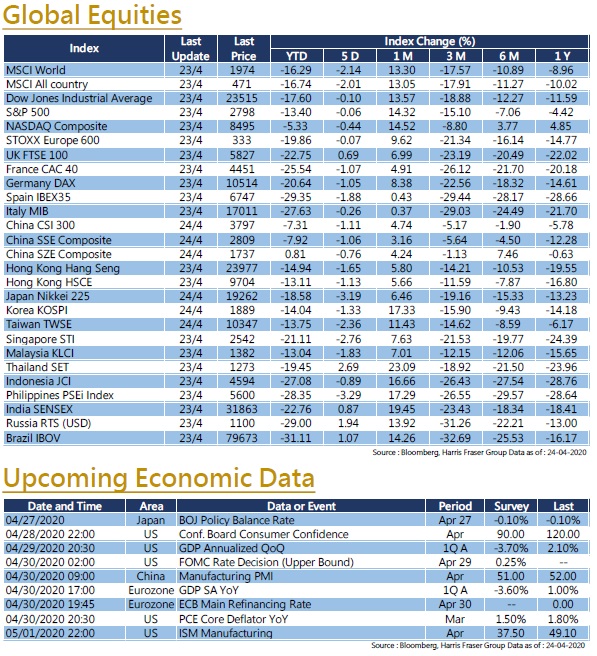

Covid-19 continued its spread across the globe, but the outbreak epicentres of Italy and the USA alike are showing signs of easing. The number of freshly confirmed cases in the US has only increased by 2.5% on Thursday, which is the smallest single day percentage increase since April. However, President Trump suggested that social distancing measures might extend until summer. After the recent rally, US stocks corrected over the past 5 days ending Thursday, the three major indexes fell slightly by 0.1 - 0.5%. A focus in the market was the negative oil price. In the past week, May contracts of WTI oil futures fell and briefly reached negative $40 per barrel, resulting in large losses for numerous traders & brokers. In terms of economic indicators, the number of initial unemployment claims reached 4.43 million last week, totaling 26.5 million over five weeks. The US Congress passed the fourth epidemic-related bill of 484 billion U.S. dollars, the total fiscal stimulus is now around 3 trillion U.S. dollars. Next week, the US will announce 2020 Q1 GDP, market expects the QoQ growth to fall by 3.7% annualised; in addition, the US will also announce the ISM manufacturing figures and consumer confidence index. The Fed will hold the interest rate meeting next week.

EU

EU

European markets followed the global market correction, over the past 5 days ending Thursday, only the UK FTSE recorded a slight increase of 0.69%, while the German and French stock indexes fell around 1%. As for the epidemic situation, Spain recorded the highest number of new infections and death in recent weeks, while the number of daily recoveries in Italy exceeded new infection figures for the first time. The European Central Committee will consider accepting junk debt as collateral, as the European Union considers a 2 trillion Euro economic stimulation package, but the EU leaders’ summit failed to reach an agreement on the details of the economic stimulus. It was reported that German Chancellor Angela Merkel mentioned that the scale of counter-epidemic measures must be very large. Next week, the 2020 Q1 Eurozone GDP will be announced; In addition, the European Central Bank will also hold the interest rate meeting in the week.

China

China

Compared to global markets, the Chinese and Hong Kong stock markets lagged, the Hang Seng Index was down 2.25% and the CSI 300 Index fell 1.11%. Due to the covid-19 epidemic, China's GDP growth in the first quarter of the year recorded the first ever contraction since 1992, contracting 6.8% YoY and falling 9.8% QoQ. This week, the People's Bank of China lowered Loan Prime Rate (LPR) as expected, one-year and five-year rates were reduced by 20 and 10 basis points to 3.85% and 4.65% respectively. In addition, the Chinese Ministry of Finance announced an additional issue of 1 trillion in special debt quotas, market expects the government to further unveil economic stimulus measures. Next week, China will release manufacturing and non-manufacturing PMI data.

Department Activities:

Columns, media interview and online channels : “TVB News”,“TVB Big Big VIP”, “Now FINTERVIEW”, “iCable Finance”, “iCable News”, “Capital”, “Edigest”,“SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”, “Business Times”, “Quamnet”,” stockviva”and online videos produced by Harris Fraser Global Assets Management. (including but not limited to the above)