Chinese markets extended gains in August on the back of policy support and positive market sentiment. The CSI 300 Index and the Shanghai Composite Index gained 2.58% (4.48% in USD) and 2.59% (4.49% in USD) respectively, while the Hang Seng Index also rose 2.37% (2.36% in USD).

The emphasis on the “Two Circulations” drew a lot of market attention, relevant domestic sectors saw an improving outlook with policy aid. While the new economy sectors remain the core investment in Chinese markets, betting on the recovery in the real economy, some traditional sectors such as industrials, materials, or logistics alike could also benefit from the “Domestic Circulation”.

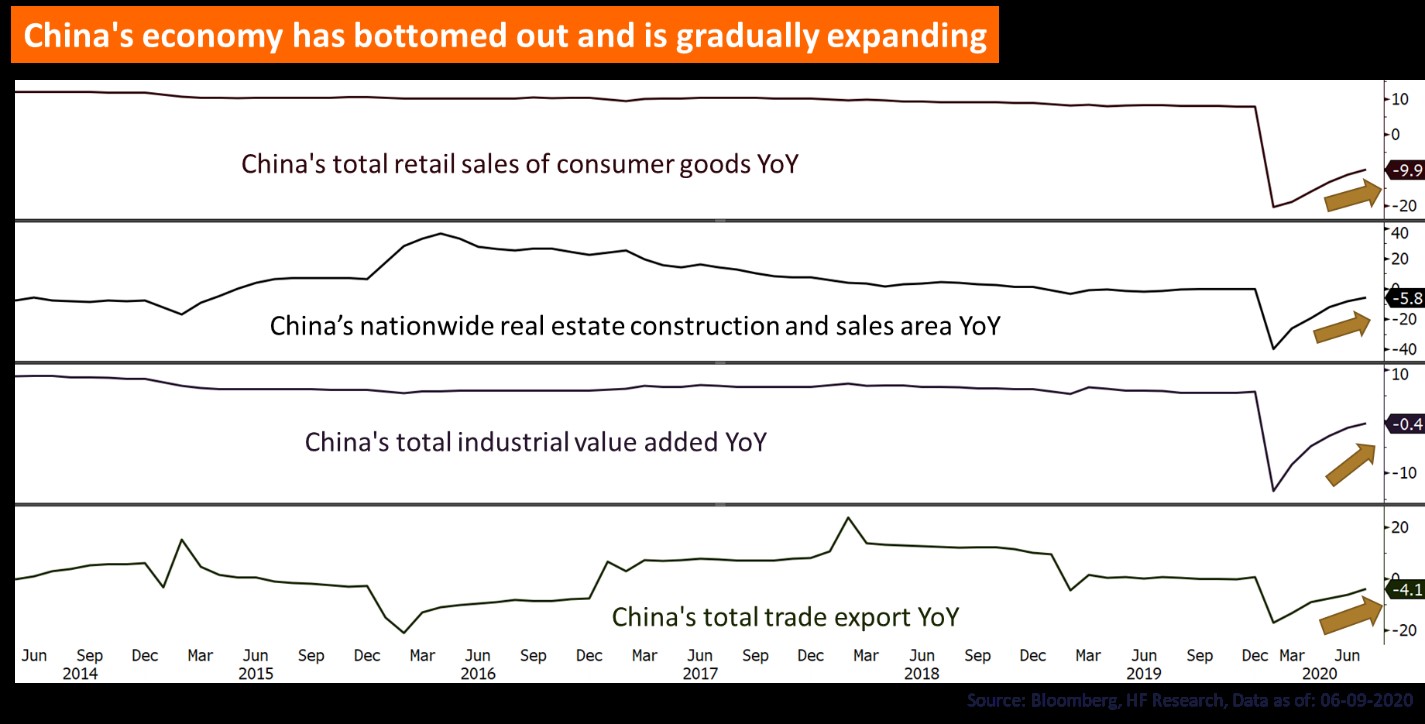

Although the economy is still significantly worse than what we have at the beginning of the year, the Chinese economy continues to improve as indicated by the steady PMI figures. Although we remain bullish on the market in the mid to long-term, investors should bear in mind that the political risks arising from trade tensions and Sino-US conflicts have risen. Together with the uncertainties posed by the US elections, we would suggest limiting exposure to relevant markets for the time being, so as to insulate from the risks as the fourth quarter approaches.