Chinese markets continued its gains over November, but visibly lagged behind global markets as the vaccine news did not offer the great boost to the market as it did to other countries. Over the month, the CSI 300 Index and the Shanghai Composite Index gained 5.64% (7.46% in USD terms) and 5.19% (7.00% in USD terms) respectively, while the Hang Seng Index also rose 9.27% (9.29% in USD terms).

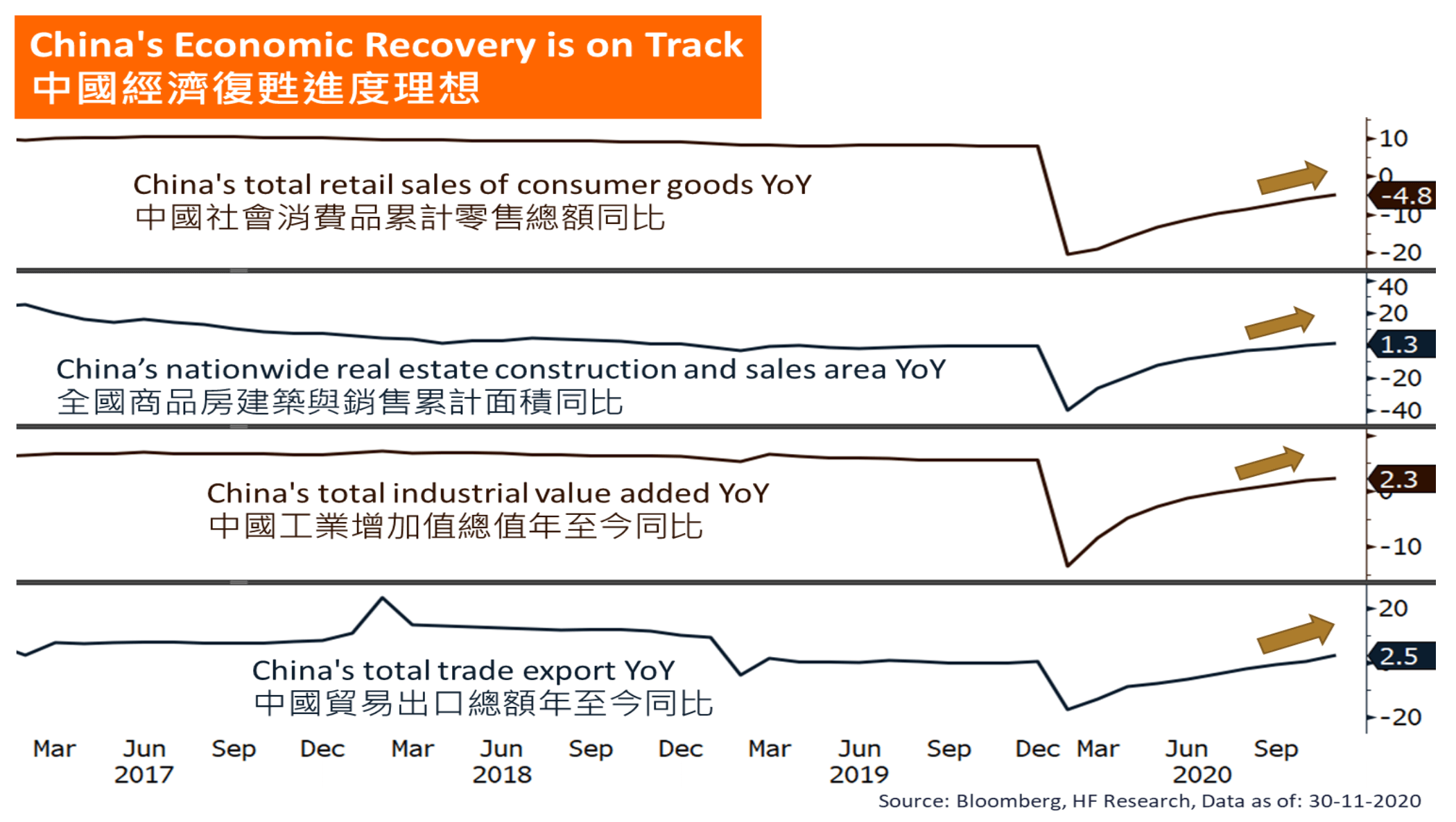

Just comparing the 2 largest economic superpowers now and we can notice that the Chinese economy is doing much better than the American one, as indicated by the low but positive growth in 2020, and a much higher growth expectation in 2021. Economic fundamentals remain strong, high frequency data including various PMIs, industrial production, and exports alike continue to show expansion YoY, which underpins the strength and resilience of the Chinese economy. As the macro factors do favour emerging markets in the short to mid-term, this forms our base for a better expectation of the Chinese equity performance outlook.

In particular, certain trends are expected to produce outperformance in the short to mid-term. As the Chinese investment market is heavily affected by governmental policy direction, industries promoted by the government as a strategic focus under the ‘dual circulations’, such as semiconductors and other disruptive technologies, or sectors that are the key to China’s migration to an advanced economy, such as e-commerce and other consumption related sectors, may see excess growth and increased capital inflows over the next few years, these should be the focus in the portfolio for the coming year.