Continuing the weak performance in September, US equities saw heightened volatility as the election date closed in, the increase in covid severity also does no favours to the equity markets. Over the month of October, the S&P 500, Dow Jones, and NASDAQ indexes lost 2.77%, 4.61%, and 2.29% respectively.

The US elections were held at the beginning of November, although the final results have not been officially announced, according to multiple media outlets, former Vice President Joe Biden have seemingly won the presidential race, but incumbent President Donald Trump have yet to admit defeat and allegedly claimed voter fraud. With the races staying tight till the very end, we don’t expect to see final results until later, but there is a very good chance that we will see a Biden administration along with a split Congress.

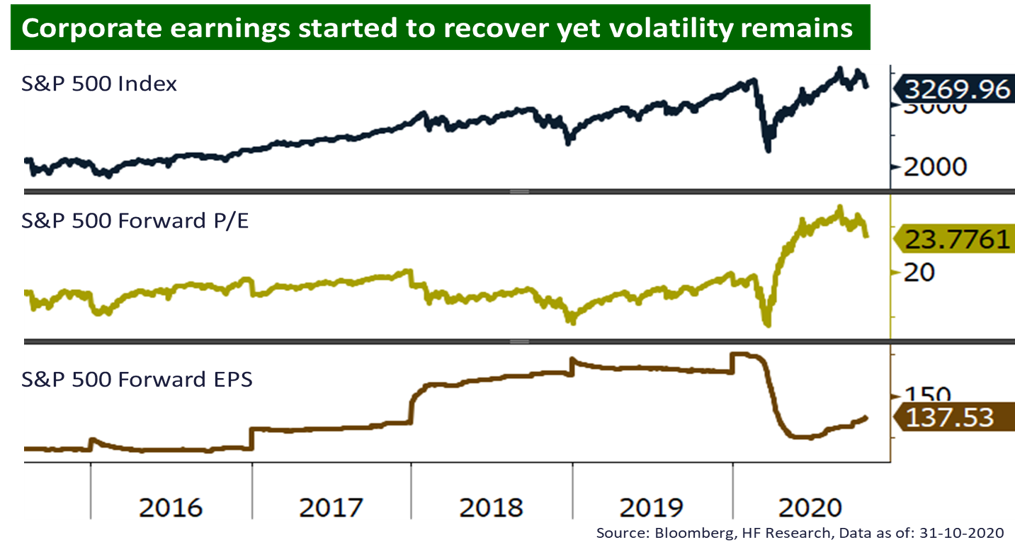

If the projected result turns out to be true, we could infer 3 key implications out of this. First off, the fiscal stimulus will likely be smaller than the original estimate, as a split Congress should put a cap on the Democrats’ wish list, which might result in less buoyancy to the patchy economy. Secondly, the more controversial policies such as a variety of tax raises will likely be postponed or withdrawn altogether, potentially alleviating the downward pressure on the investment markets. Lastly, an expected normalisation of foreign relations, including a possible rollback of tariffs and sanctions, should support the global economic recovery. That said, the current market is still on the higher end in terms of valuations, yet the US market should see positive gains on the longer term as corporate earnings recover.