US

US

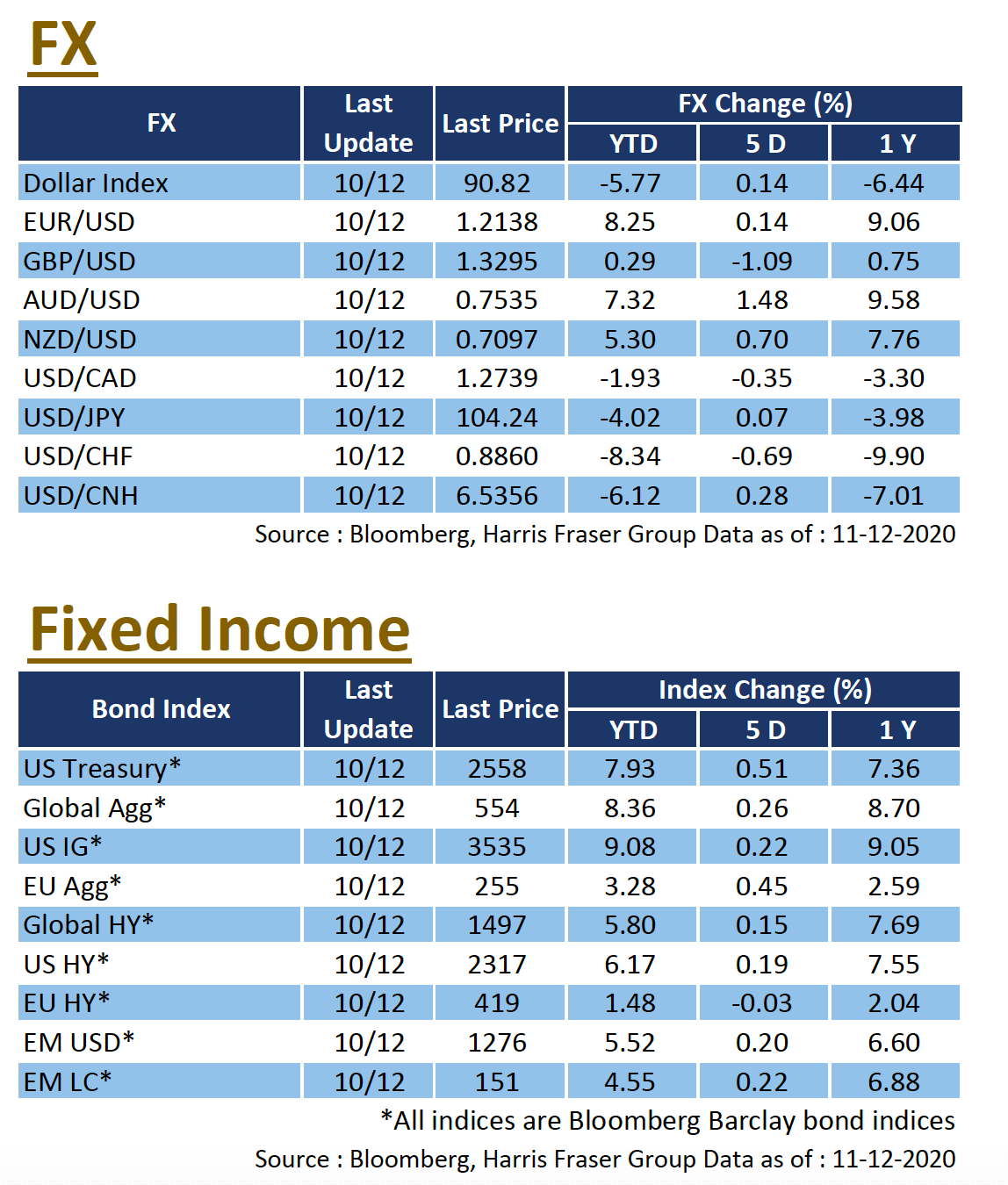

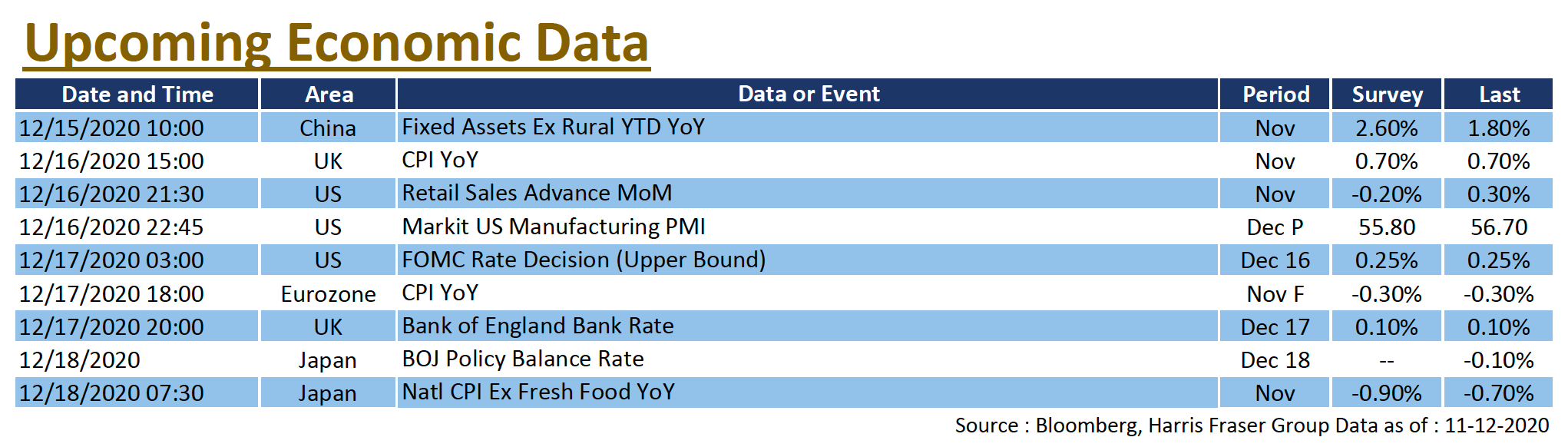

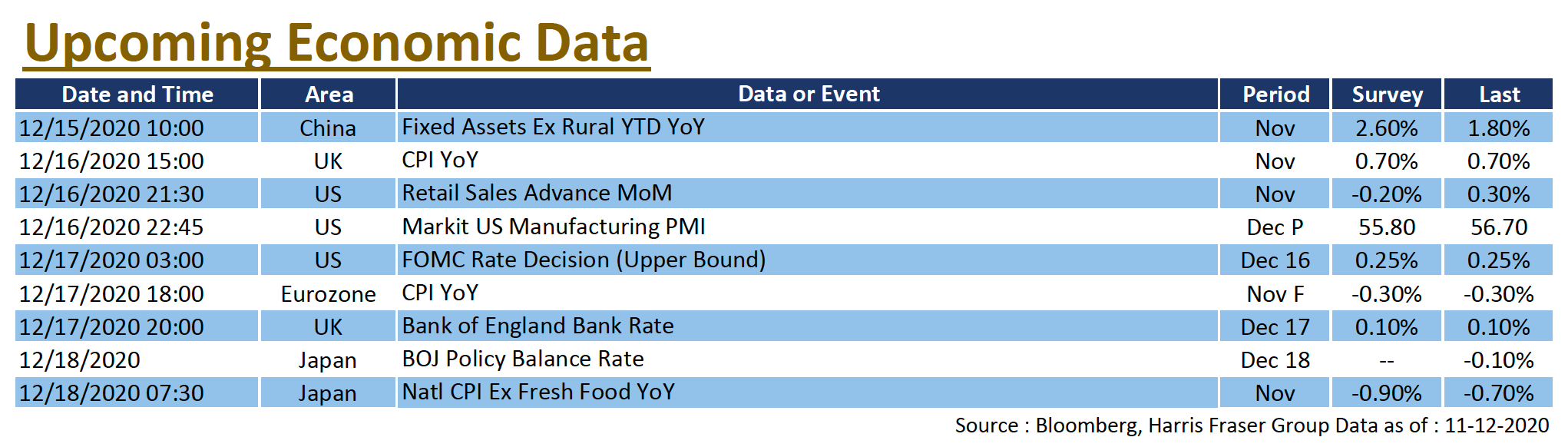

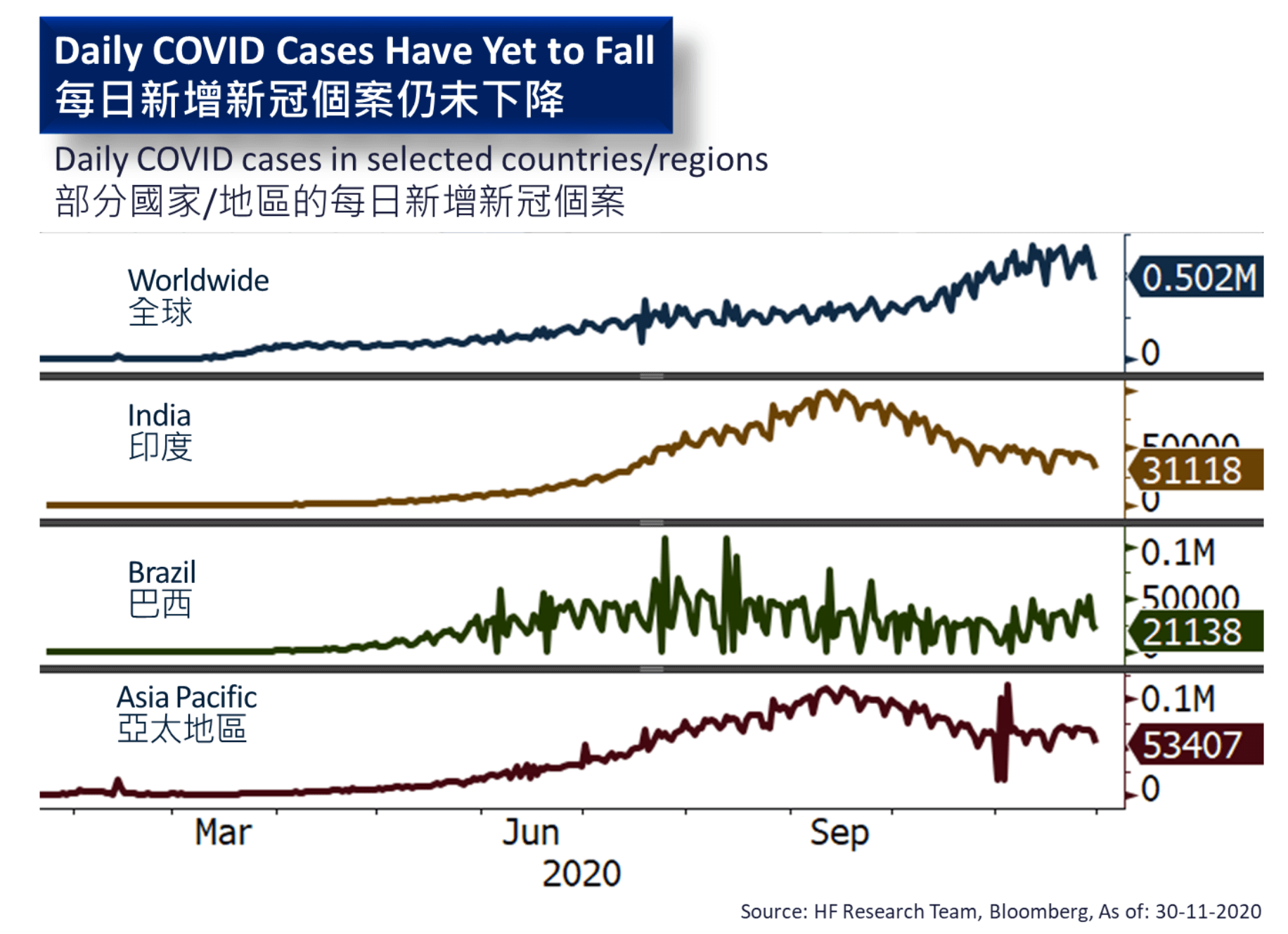

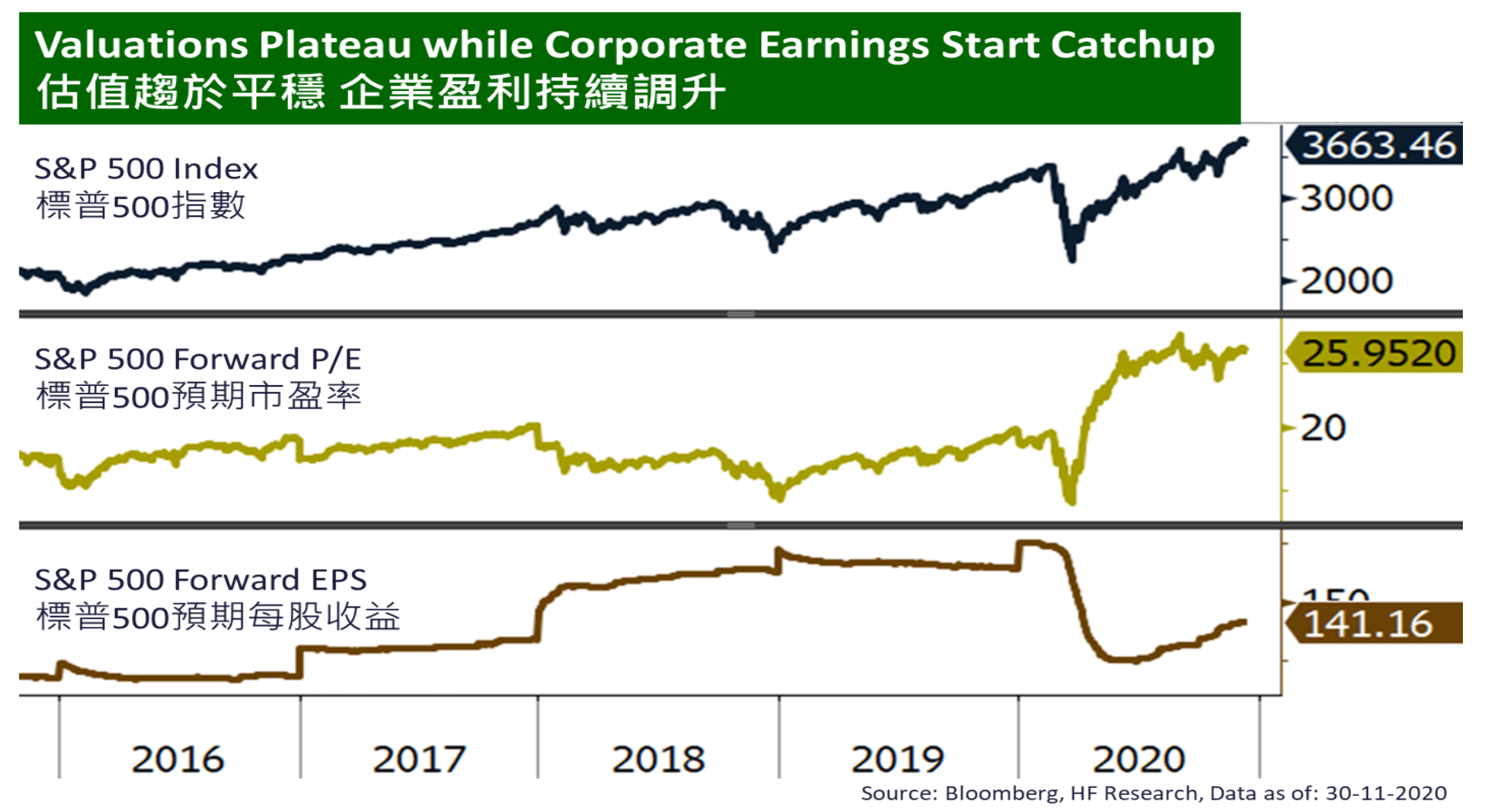

The US Food and Drug Administration (FDA) said the Pfizer COVID vaccine is safe and effective, but on the other hand, the US fiscal stimulus package remains in a standstill, with US stocks trading in a narrow range close to historic highs for now. The three major US stock indexes saw minimal movement over the past five days ending Thursday, but the tech giants' performance was hampered by news of the anti-trust lawsuit against Facebook. On the fiscal front, US Treasury Secretary Steven Mnuchin and House Speaker Nancy Pelosi both said progress was made, but a few key issues remain and are currently going nowhere. The COVID epidemic continues to ravage across the country, the US saw its daily COVID deaths exceed 3,000 for the first time, whereas the advisory panel to the FDA recently endorsed the Pfizer vaccine based on clinical trials results, which would suggest a likely green light for emergency use authorization. However, recent data shows that the US economy is not performing as well as expected with the recent number of initial jobless claims unexpectedly surging to the highest level since September. In addition, the US Consumer Price Index rose 1.2% YoY in November, slightly surpassing market expectations. Next week, the US Federal Reserve will be in the spotlight as it meets to discuss about the economy and monetary policy outlook for the coming year, the US will also release data on retail sales and manufacturing PMI.

Europe

Europe

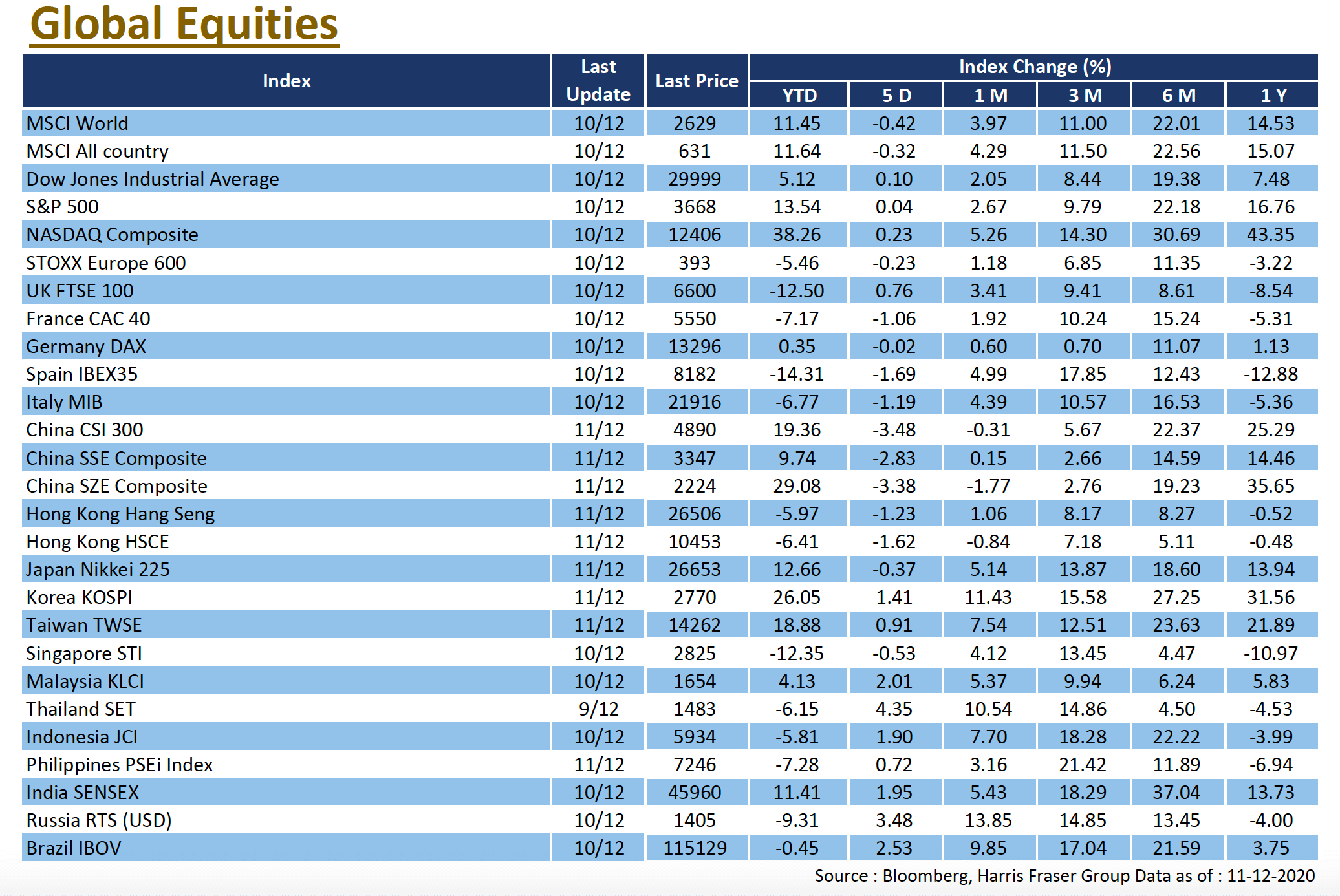

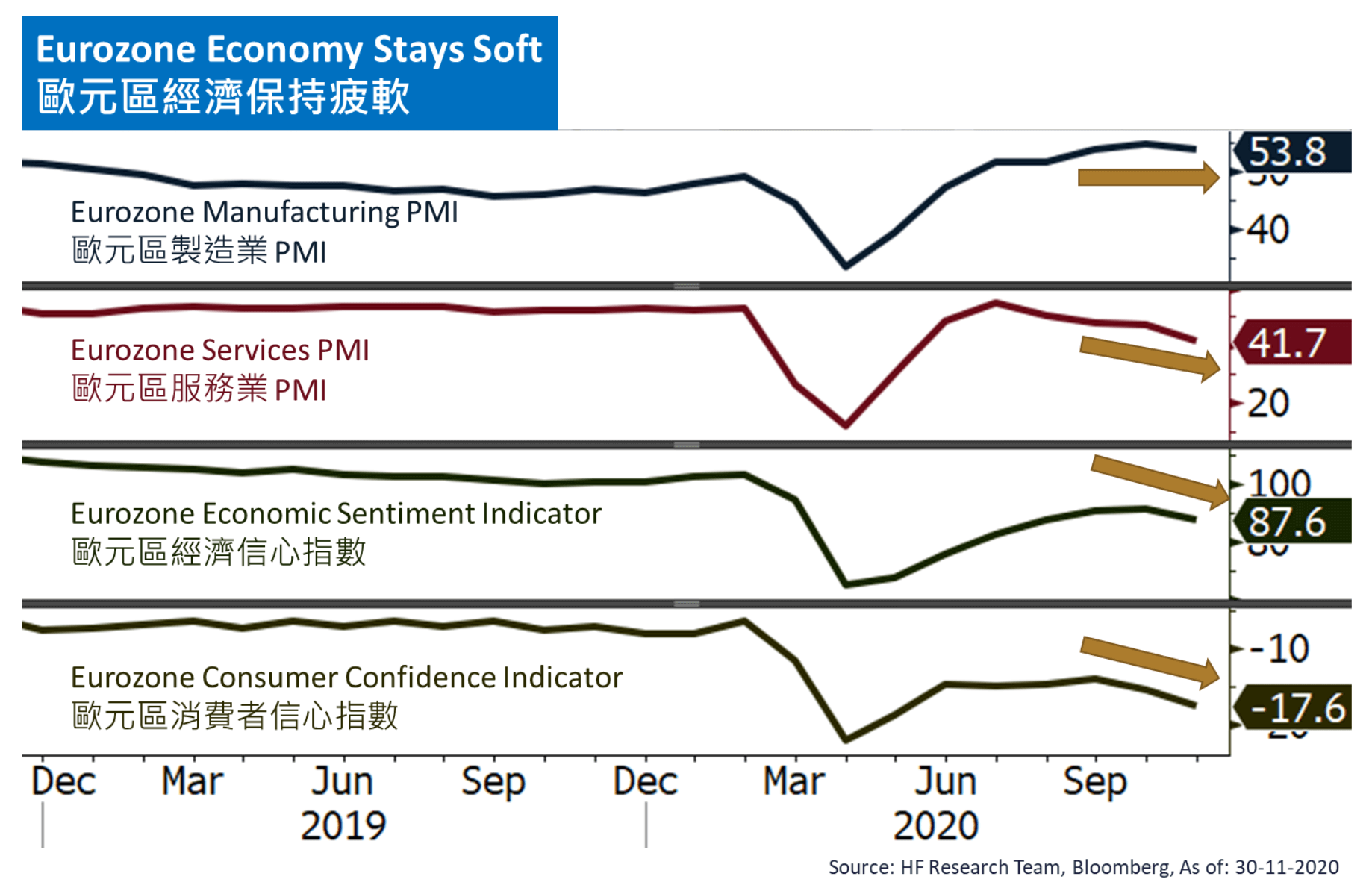

The European Central Bank's (ECB) announcement to raise the cap and extend the Pandemic Emergency Purchase Programme (PEPP) seems to be ineffective in boosting market sentiment, with the UK, French, and German stock markets lacking momentum over the past 5 days ending Thursday. The ECB kept policy rates unchanged, but increased the size of PEPP by 500 billion Euros and extended it for another nine months. ECB President Christine Lagarde said the second wave of the epidemic could cause the economy to contract sharply in the fourth quarter, so the growth forecast for 2021 was lowered. Brexit talks remain rugged and tortuous, with both sides agreeing to extend the deadline until Sunday, but UK Prime Minister Boris Johnson warned the market to be prepared for a no-deal Brexit, raising fears of more uncertainties in the negotiations, the Pound softened against both the Euro and the US Dollar. Next week, the Eurozone and the UK will release their consumer price index figures.

China

China

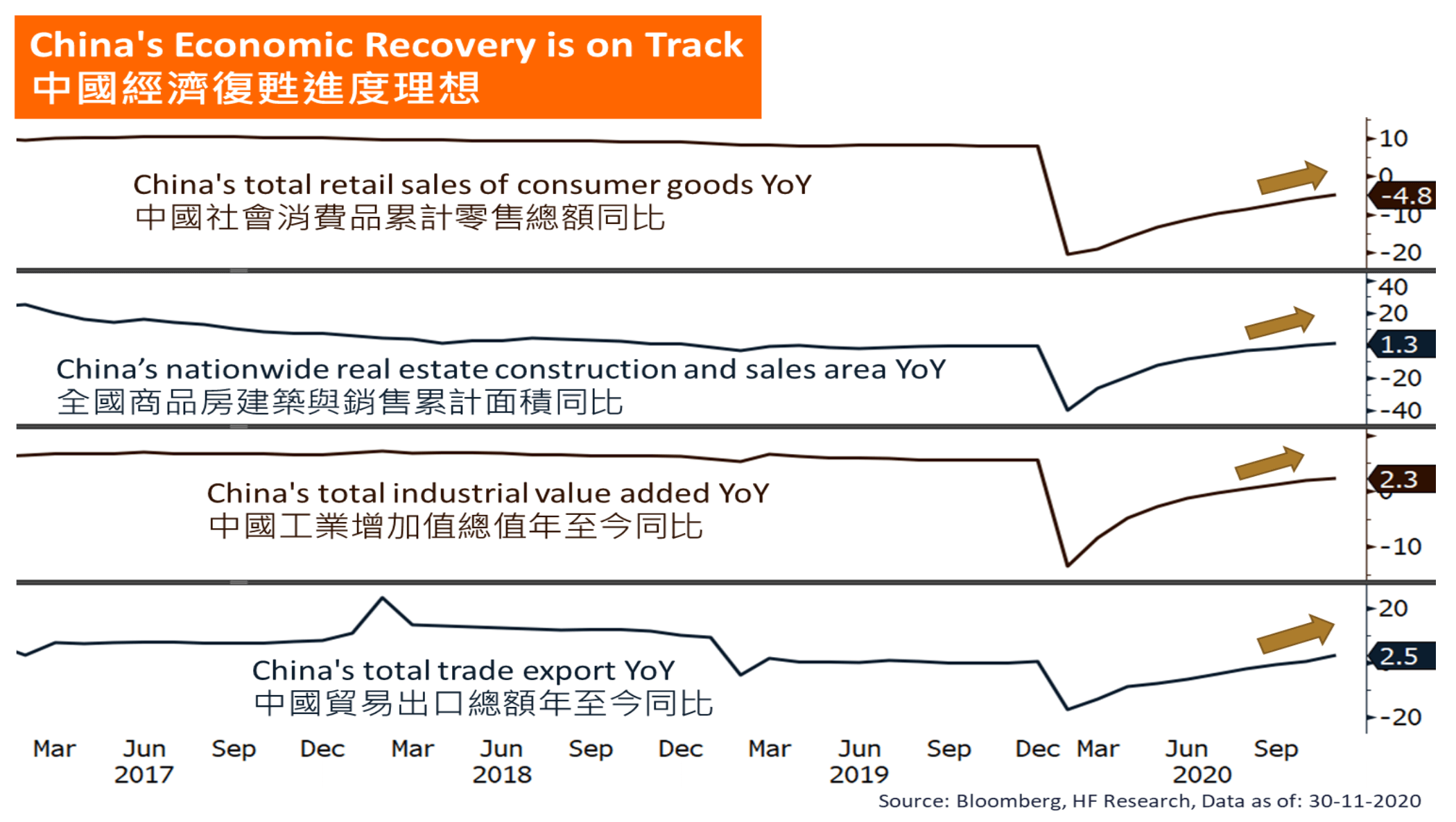

Some of the international Indices were requested by the US government to exclude certain Chinese companies, weighing on individual stock prices and the general market sentiment. China A-shares and Hong Kong stocks softened this week, with the CSI 300 index down 3.48% and the Hang Seng index down 1.23%. China recently released a number of economic data, exports in USD terms rose 21.1% YoY in November, which is the biggest increase since February 2018, while China's CPI fell 0.5% YoY in November, which is the first time CPI went negative since October 2009. Next week, China will release November fixed investment figures, industrial production, and retail sales data.

US

US Europe

Europe China

China