Weekly Insight November 20

US

US

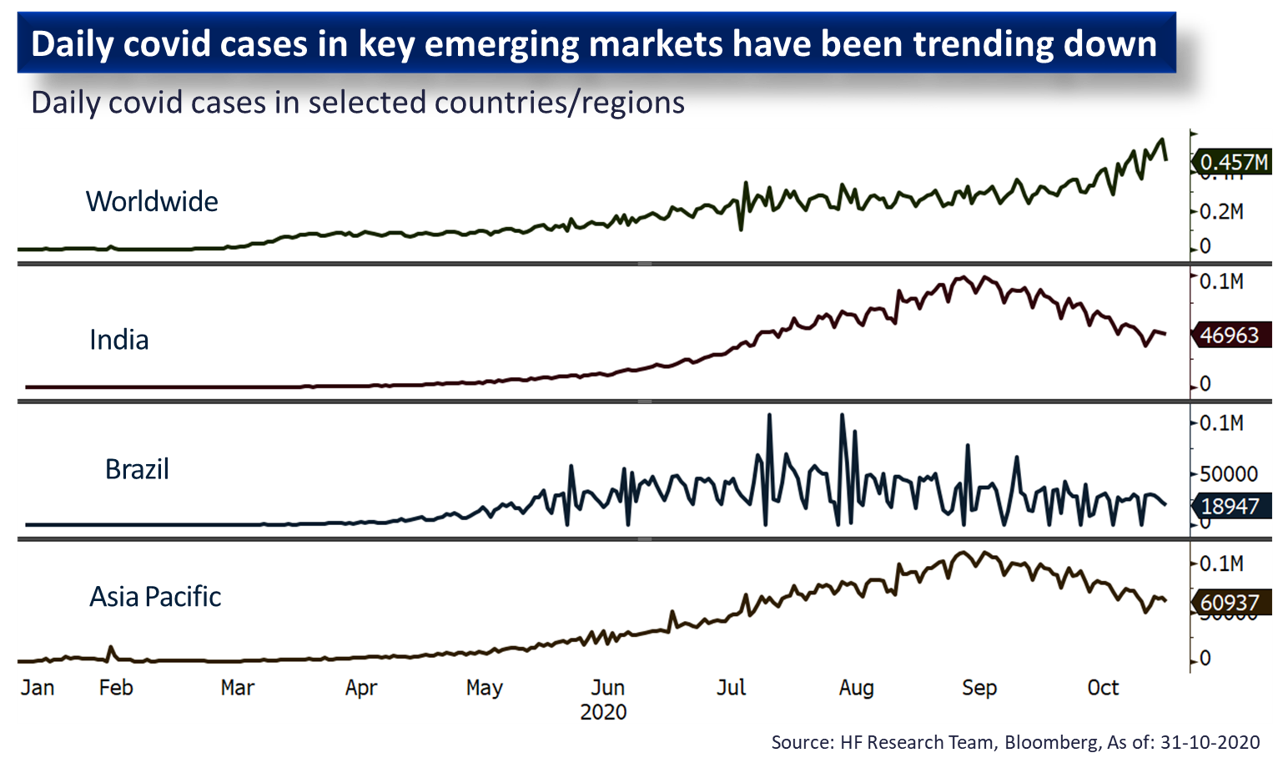

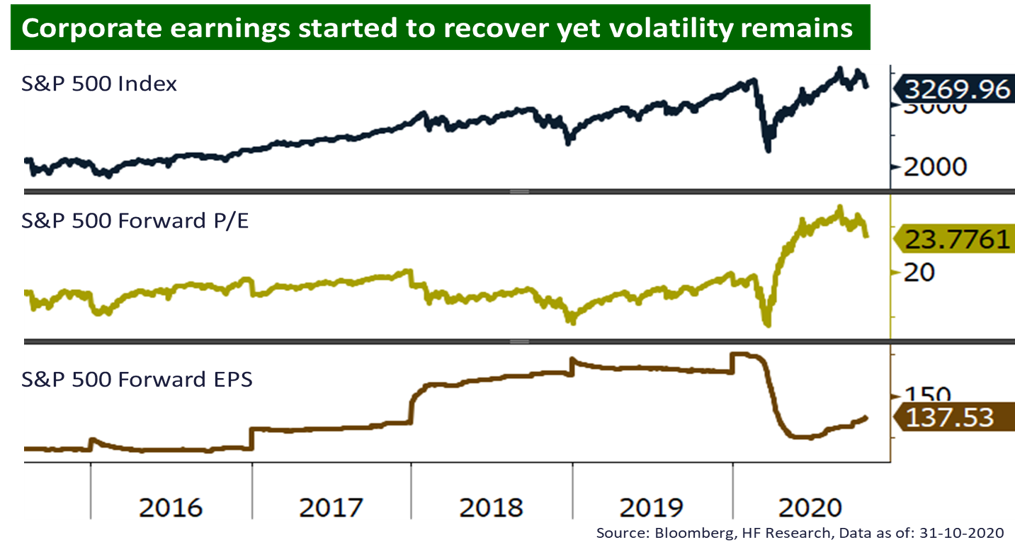

The epidemic situation in both the US and Europe remains severe, but uncertainties in the US elections cleared, coupled with claims by two pharmaceutical companies on their near 95% efficient vaccines, market sentiment stayed positive and US equities continued their upward trend. Over the past 5 days ending Thursday, all three major equity indexes rose 1.27% to 1.67%. As for the US elections, Trump has yet to admit defeat, but according to mainstream media, Biden has already secured a victory, and had reportedly called for a formal transition process, he has also decided on his choice for the Treasury Secretary. With daily infection figures in Europe and the Americas staying elevated, the International Monetary Fund warned that the new epidemic restrictions will hamper the global economic recovery. In addition, US Federal Reserve Chairman Jerome Powell stated that the epidemic continues to pose a short-term downside risk to the economy, and it is still too early to withdraw emergency lending facilities. In fact, US retail sales grew at the slowest pace in the past six months, reflecting the weak momentum of the recovery. Next week, the US will be releasing more economic data, including the consumer confidence index, as well as the minutes of the November interest rate meeting.

EUROPE

EUROPE

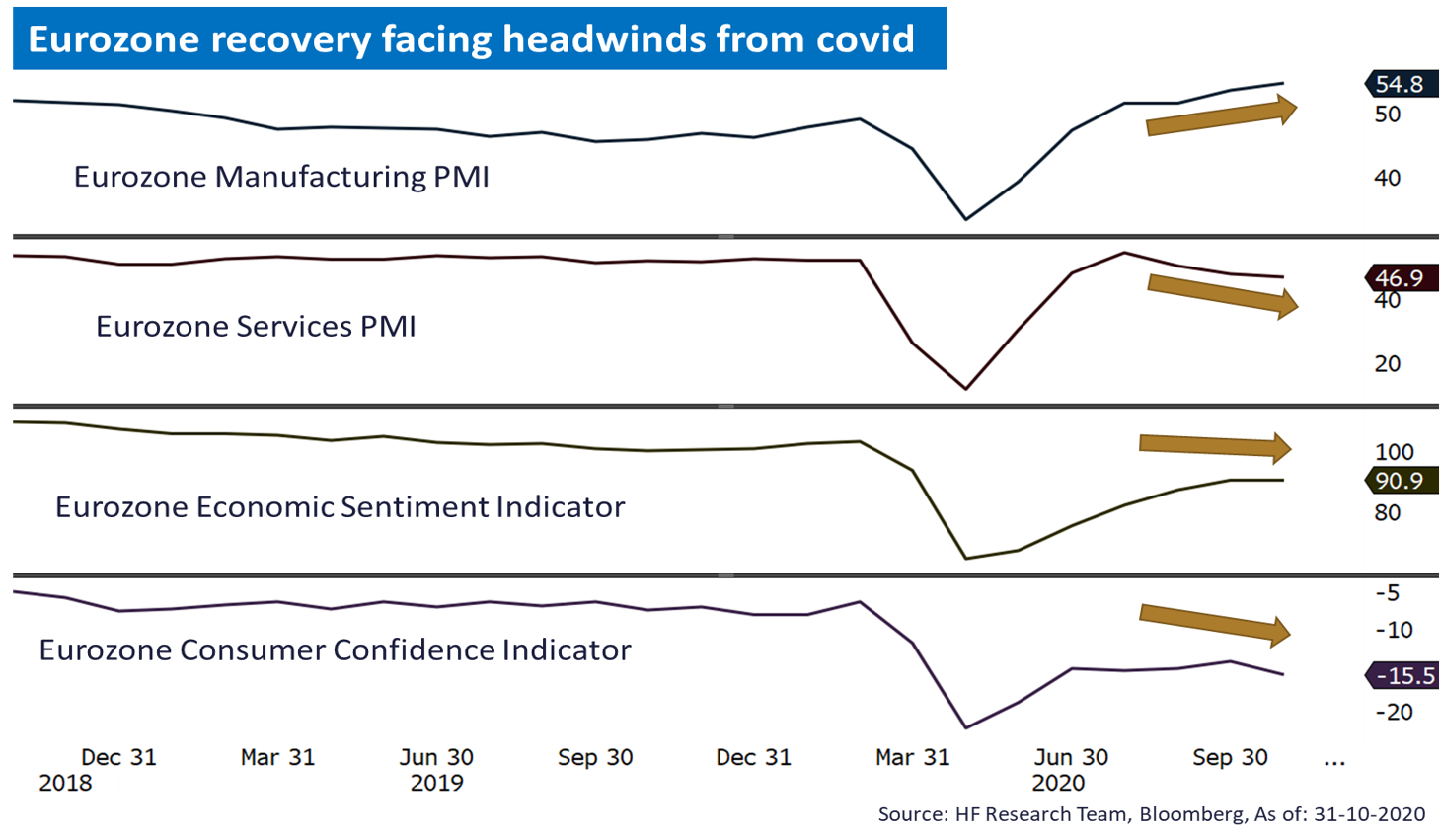

Following the earlier rally, European equity markets have stabilized. Over the past 5 days ending Thursday, German, French, and UK equity indexes posted varying results ranging from -0.07% to +2.09%. Although there has been positive news on the COVID vaccine, European Central Bank (ECB) President Christine Lagarde said the bank will make no changes to its monetary stimulus plan. She expects a strong stimulus package to be ready in December, and also urged EU governments to roll out additional epidemic relief measures as soon as possible. On the other hand, the UK's Brexit trade talk deadlines are closing in, but the talks have recently been suspended due to a key official contracting COVID. Next week, the Eurozone will release its manufacturing purchasing manager index.

CHINA

CHINA

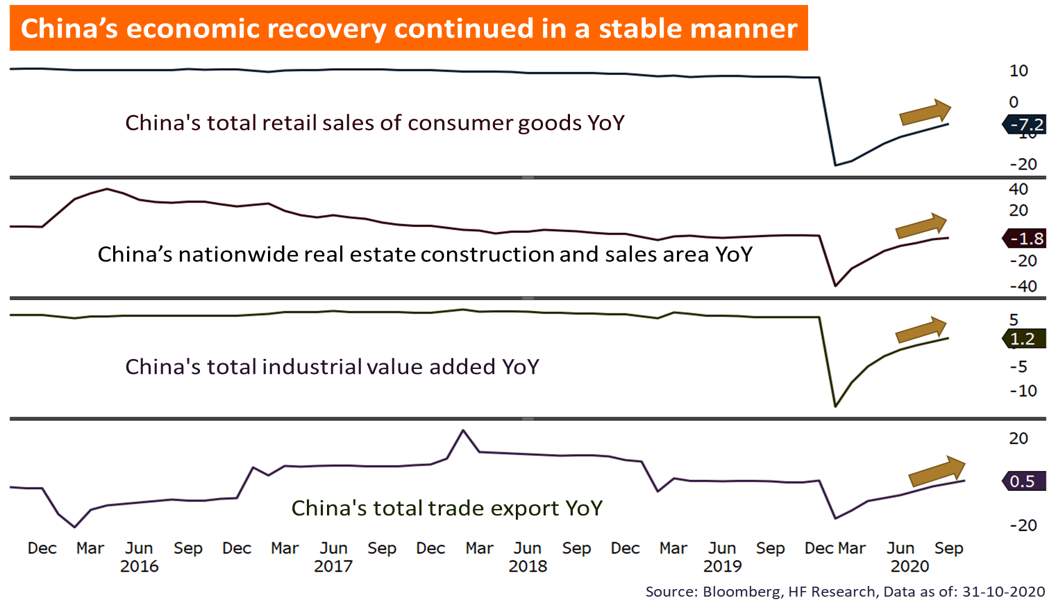

After digesting the vaccine updates, Hong Kong and mainland Chinese stock markets tapered off, the CSI 300 Index rose 1.78% this week and the HSI gained 1.13%. As of Friday, the number of new COVID infections in Hong Kong was on the rise, fears of a 'fourth wave' of epidemic weighed on certain local property developers, while epidemic beneficiaries gained ground. Premier Li Keqiang chaired a meeting on Wednesday, stating the importance of expanding domestic demand, driving optimism in the domestic consumption sectors such as home appliances. Next week, China will announce the industrial profit figures in October.